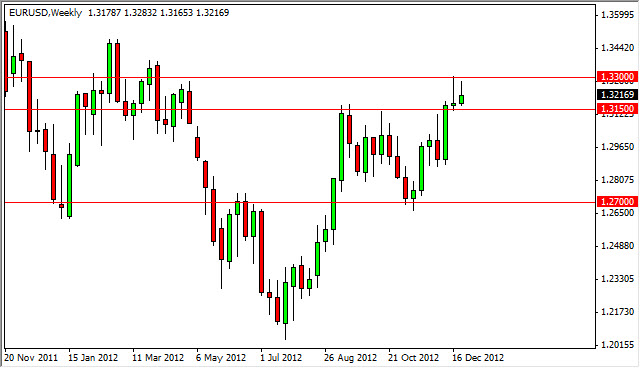

EUR/USD

The EUR/USD pair failed to break above the 1.33 resistance level for the second week in a row this past week, and the fact that Christmas was on Tuesday certainly did little to help. The pair seems “stuck” between the 1.33 and 1.3150 levels at the moment, and with the “fiscal cliff” talks struggling in the United States, it is likely to continue to go sideways until we get some kind of resolution – or lack of.

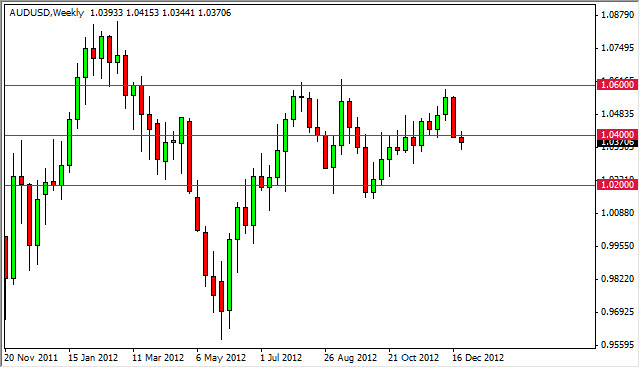

AUD/USD

The AUD/USD pair fell slightly over the week, but continues to stay above the 1.03 level. The 1.04 level is resistive as well, and just like the EUR/USD pair – this market can’t figure out where to go at the moment. The pair is of course a risk sensitive market, and because of this I am somewhat surprised that it remains as buoyant as it is at the moment. The Aussie remains a favorite of currency traders as a proxy for risk, and because of this I think that if we finally get a resolution to the fiscal cliff in America – this pair could skyrocket. I think a move above the 1.04 level would signal that the risk is back in the market, and as a result I would be long of this market on a daily close above that level. I am not a big fan of shorting though, as I see a lot of “noise” below.

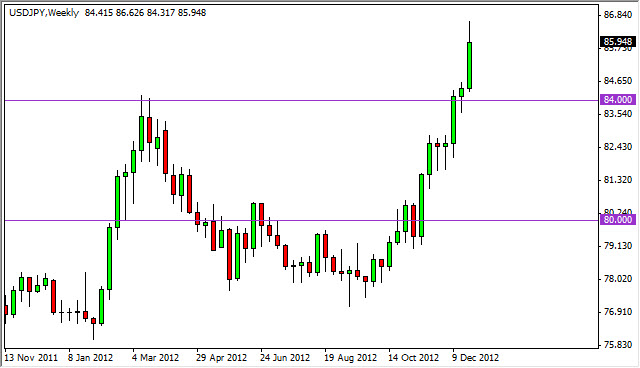

USD/JPY

The USD/JPY pair fell on Friday but had a very strong week. The pair continues to breakout and the Bank of Japan should continue to work against the value of the Yen. The opposition leaders of the LDP should press the BoJ to really pummel the currency, and the inflation target will now be 2%. This will require a lot of Yen printing and foreign bond purchases. Because of this, I think this pair continues higher over the long run. I do however see the very real possibility of a pullback to the 84-85 area in the near term. Because of this I feel this is a pair that is better bought on the pullbacks.

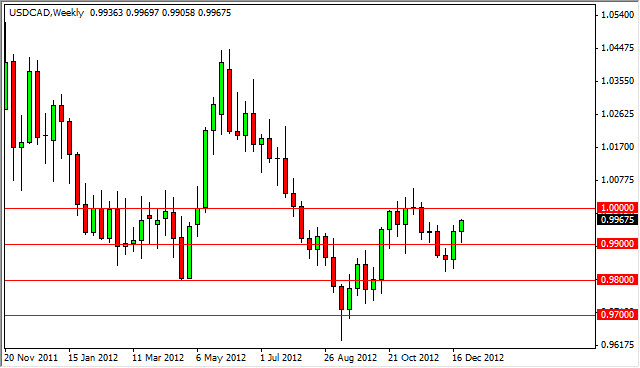

USD/CAD

The USD/CAD pair bounced off of the 0.99 handle this week to form a nice looking hammer. This hammer suggests that the pair is going to try and break above the parity level again. The real top of the resistance at that area will be 1.0050 though, and because of this I want to see a move above that level before buying.

As for selling, I think if we get a good deal in the fiscal cliff discussions, this pair could fall. A break of the bottom of this week’s hammer would be a good signal to start selling. I see this as essentially the 0.99 handle.