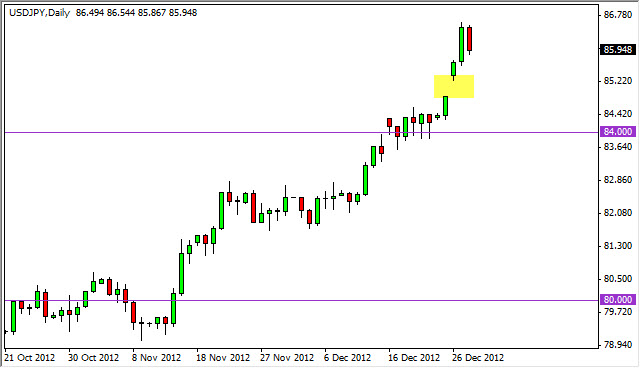

The USD/JPY pair fell during the Friday session as the market finally salsa negativity. This pair has shot straight up from the 84 handle, and as an exclamation point to the situation we managed to gap up higher after the Christmas break. This gap form that the 85 handle, and as such it looks like that level will offer support. It's quite common to see a market gap and then pullback to "fill the gap" before going back in the original direction.

Given the fact that the Bank of Japan is about to massively expand its monetary policy, I personally believe that filling this gap in moving to the upside afterwards makes perfect sense. Nonetheless, buying at this point in time is paying up a little bit too much for my liking. I'm already long of this pair, but I certainly wouldn't be adding here.

If we get some type of supportive action right around the 85 handle or just below, I'd be more than willing to add to my already long position. I believe that we will see the 90 handle before it's all said and done, and as soon as the American leaders can come up with some type of fiscal agreement, we could see this market take off.

84 is the floor

Going forward I think that 84 will be the floor in this market. Anything below that and the Bank of Japan will almost certainly get involved. They've already stated that they want to see the Yen trade at the 90 level against the US dollar, and as a result we will find that level sooner or later.

I understand that the Federal Reserve is expanding its monetary policy as well, bonds the new leader in Japan, Mr. Shinzo Abe, has already stated that he is going to pressure the Bank of Japan to print "unlimited" Yen in order to reach an inflation target of 2%. Japan has not seen an inflation reading of 2% in almost 20 years. Because of this, they're going to have to go into hyper drive on the printing presses. I believe that this will be one of the best trades of 2013, and that buying on the dips will reward you over time for the foreseeable future.