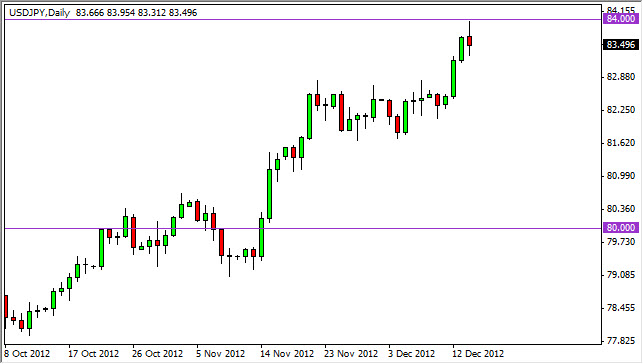

The USD/JPY pair as we smash into the 84 handle. If you been paying attention to anything that I find out recently, you know that I think the 84 level is crucial in determining which direction this pair goes over the next several months, if not years. Having said that, I do fully expect to see this pair break out sooner or later, the question then becomes when will see this.

Today will be a very important session for the future of the Yen, as the Japanese elections will determine the makeup of Parliament. The lower house looks like it could possibly have 320 seat occupancy of the LDP party, and this would give them the end around that they are looking for in order to be able to bypass the upper house and impose their will upon the Bank of Japan. They have stated very publicly that they are looking for the Bank of Japan to absolutely crush the Yen, (those are my words, of course) as the country has reentered a deflationary situation. In fact, they have suggested that they need to see an inflation target of 2 to 3%.

Buy-and-hold?

Once we start to get election results, this currency pair will be very interesting, very quickly. The Yen related pairs all looks set to break out, and it is known that the Bank of Japan will have to do something soon because of the deflation. Because of this, no matter what happens we expect a certain amount of quantitative easing coming out of the Japanese central bank, the real question will be who controls the actions as there are suggestions that the government will strip the central bank of some of its independence.

Either way, it does look like we are finally going to break out of the malaise this pair has seen for quite some time. This will be an interesting market to trade again, as we could get a nice long-term trend is forming soon. I personally believe that this market will eventually hit the 110 level, although obviously that's not going to be in the near-term. Because of this, if we break out above the 84 handle I will begin building a massive position for a long trade in this currency pair.