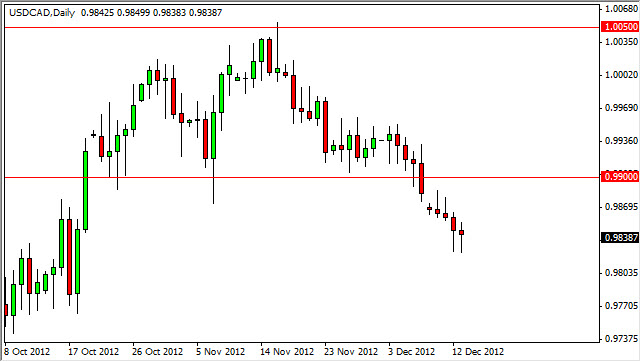

The USD/CAD pair had another negative session during the Thursday trading hours, but has again seen the 0.98 handle step in and provide support. I currently think this pair is more bearish than bullish, and I believe that the 0.99 giving way as support was a significant move. After all, the 0.99 handle was significant support over the course of three months. The fact that we broke down below it, and then continued lower of course was very bearish and its implications.

Since then, we've seen a bounce back and an attempt to reach the 0.99 handle on both Monday and Tuesday, but failures ending in shooting stars. However, on Wednesday and Thursday both we have formed hammers. This suggests to me that we are going to consolidate a bit, and I believe it is based upon what's going on United States presently.

It appears that Congress controls the Canadian dollar

The USD/CAD pair typically will move with the US economy. Both of these economies are highly leveraged towards each other, as the Americans depend on Canadian oil, while the Canadians depend on the Americans to buy 85% of their exports. Because of this, the whole issue in the US with the so-called "fiscal cliff” is presently having a great affect on this pair. After all, the Canadians are going to need customers to buy all those exports, and if the Americans are too broke, they won't be buying much.

I currently believe that we are still going lower over time, but the congressional monkey shines that are going on presently certainly is making it much more difficult to break down that should be. Granted, I do see a bit of a cluster of noise between 0.97 and 0.98 that could be causing a bit of support as well, but overall, the 0.99 level was much more supportive and significant than what we're dealing with now.

Until we get some type of resolution to the situation, I feel that consolidation in this general vicinity is probably the way things are going to go. It'll be interesting to see what happens when a resolution comes, because it should be bullish for risk appetite. This should send the pair down eventually, and it could very well, a couple weeks down the road - when liquidity will be at its absolute lowest. Because of this, the move could be sudden and brutal.