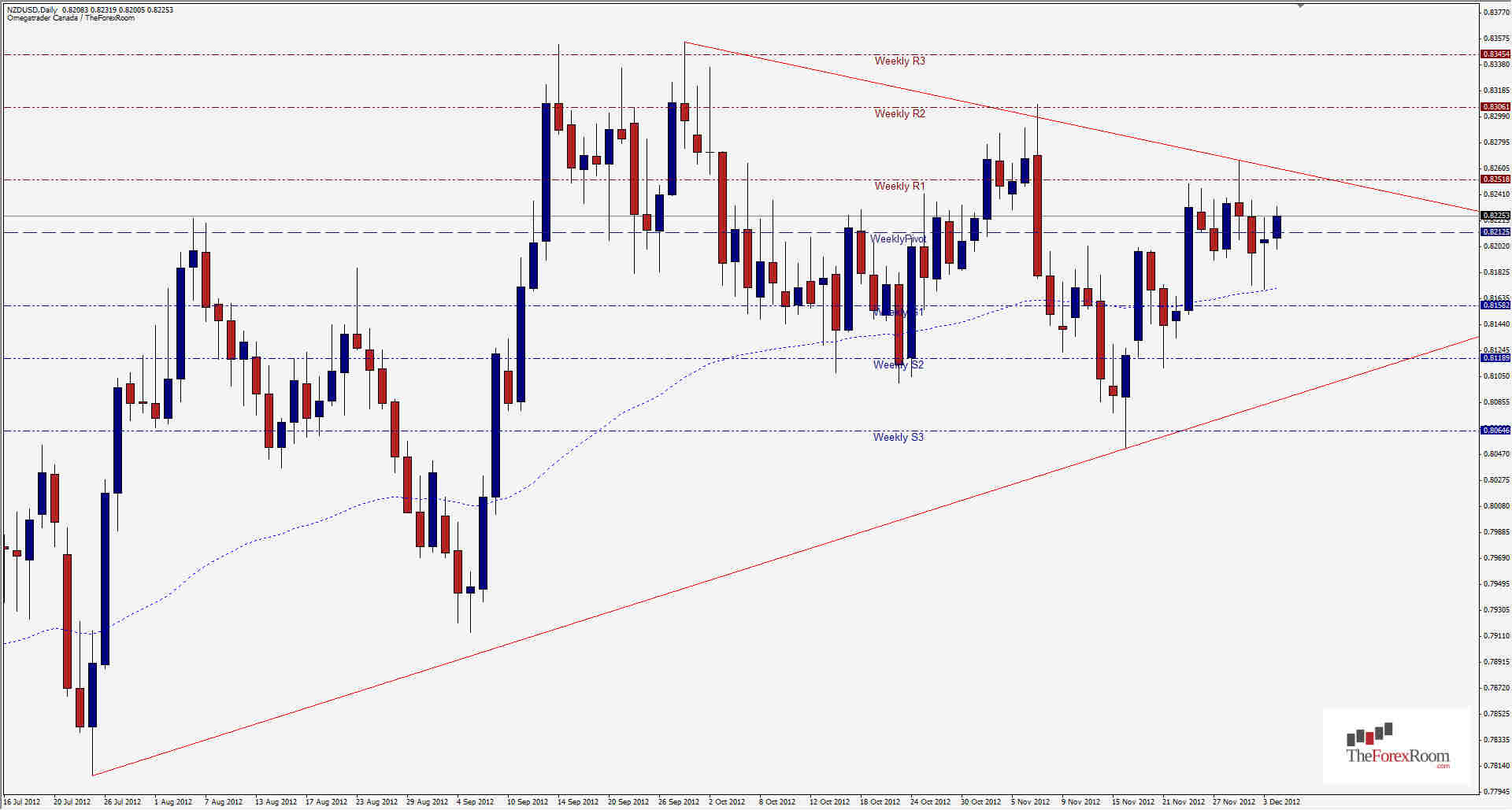

The Kiwi got a little boost out of the Australian RBA announcement during Asian trading which saw the RBA reduce the Overnight Cash Rate to 3.00 from 3.25. This seems to have given the currency in question some legs, at least short term if not longer. The pair has climbed some 30 pips since the announcement only a few minutes ago, kissing the Daily R1 at 0.8231 so far. If the bullish momentum continues we could see the pair finally break free of the consolidation area that the pair has been in since September between 0.8250 and 0.8120. To confirm this possibility however, the pair will really need to break above the 3 touch descending trend-line seen on the Daily Chart at 0.8267 which is also last week's high. Both support and resistance are plentiful around the current price of 0.8225 with immediate resistance at 0.8237, a Weekly R1/Daily R2 combination at 0.8250 and the previously mentioned trend-line above. Support sits at 0.8197 which is the low for the past 12 hours, a Monthly Pivot at 0.8186 and Weekly S1 at 0.8158 followed by the Weekly S2 at 0.8119. This pair is more bullsih than bearish in this traders opinion, but caution is strongly advised below 0.8260.

Kiwi Consolidation Continues

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- NZD/USD