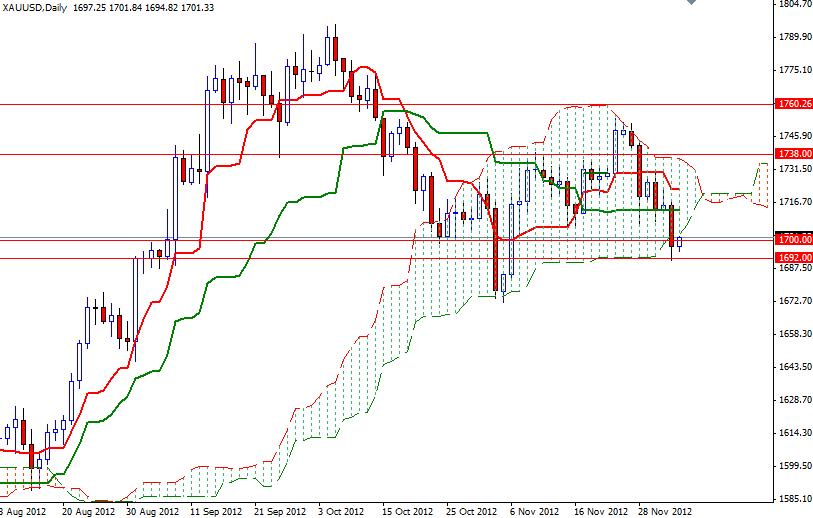

XAU/USD has seen quite a selloff recently as the market conditions (fundamentally and technically) have been working against gold. Unresolved negotiations in the U.S. and fiscal problems in the eurozone have been causing volatility in the markets. Meanwhile, commodities (including gold) continue to struggle as weak manufacturing data came out of the U.S. and eurozone raised further concerns about the world economy. Honestly, it is not surprising to see some retracements as investors take some of profit off the table as the market sees profit taking this time of year (last December gold prices had dropped to 1560 from 1760 just in 5 days). Gold finished last year at 1562.85, so it’s up more than 8% so far. Technically speaking, yesterday’s downswing could be the beginning of a much more serious selloff. On the daily time frame, XAU/USD closed below the Ichimoku cloud yesterday, indicating that the bears are firmly in control.

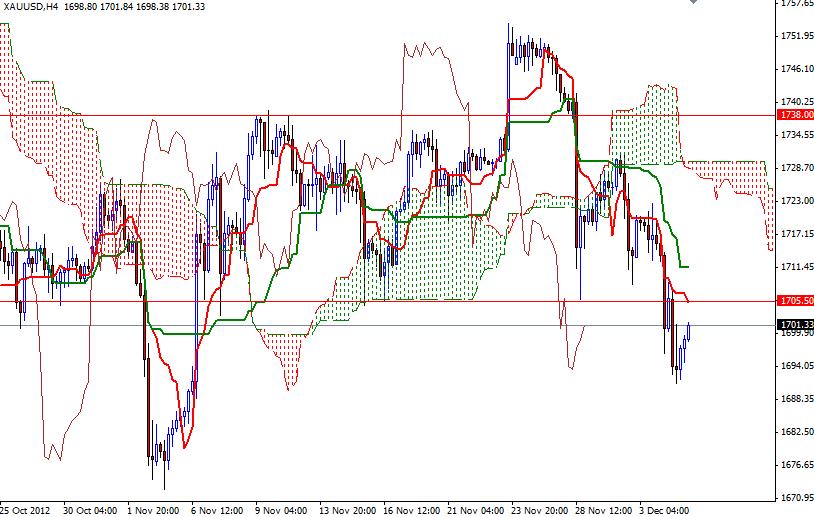

On the 4 hour chart, prices are well below the Ichimoku cloud and also the Tenkan-sen line (nine-period moving average, red line) is below the Kijun-sen line (twenty six-day moving average, green line). In addition, Chikou span (brown line) indicates lower prices will come. Only a close above the 1723 level could ease the bearish pressure. In order to revisit that level, the bulls will have to break above 1705.50 first. Above that, there will be more resistance at 1711.34 and 1717.84. If the bears successfully defend the 1705.50 barrier and the pair resumes its bearish sentiment, look for 1692, 1685.34 and 1677.