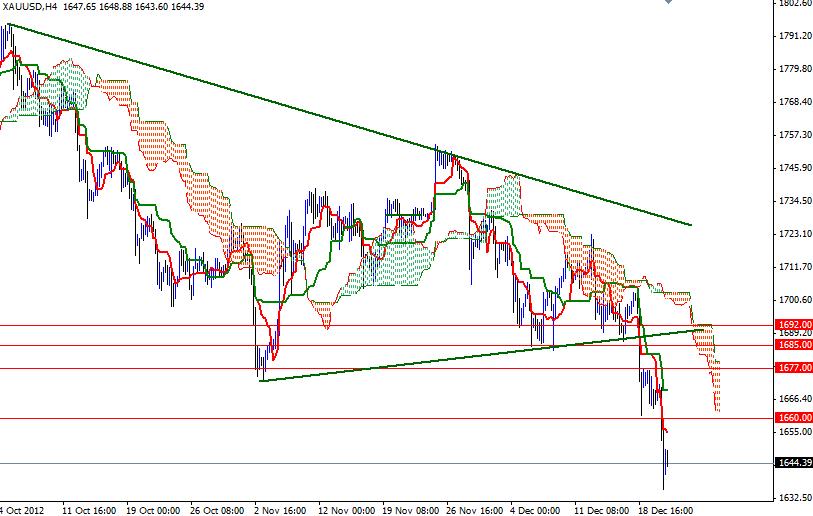

XAU/USD (Gold vs. the Greenback) continued its bearish free fall yesterday and hit the lowest level since August 23. Prices fell below the critical support level of 1660 after a report from the Commerce Department showed the U.S. economy grew at a 3.1% annual rate in the third quarter. Better-than-expected data fueled expectations that the Fed will become less aggressive. The sell-off triggered by the gross domestic product numbers gained momentum after the latest report released by the National Association of Realtors revealed that sales of previously owned homes increased 5.9% to a 5.04 million annual rate in November. Combined with the increase in the number of building permits, it appears that the housing market recovery will extend into the next year. I had mentioned the importance of the 1660 support level yesterday. As we closed below this level, I believe XAU/USD is headed lower towards the 1627 level. However, the pair may pause at that point as there is a significant support at the 1627 level which was the upper line of an ascending triangle formed between May and August. This level also coincides with the bottom line of the Ichimoku cloud on the weekly time frame. If XAU/USD encounters strong support at 1627 and reverses, there will be resistance at 1644, 1653 and 1660. If the bulls fail to defend the 1627 level, expect to see additional support at 1620.40, 1610.75 and 1605.85.

Gold Price Analysis- Dec. 21, 2012

By Alp Kocak

Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

- Labels

- Gold