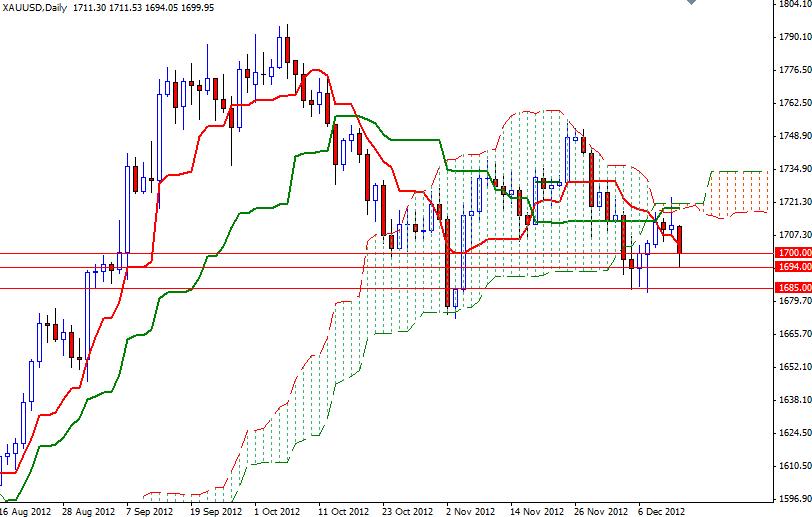

XAU/USD (gold vs. the American dollar) rallied yesterday after the Federal Open Market Committee said the Federal Reserve will buy $45 billion a month of treasury securities starting in January to bolster the economy. The Federal Reserve also said interest rates will remain extremely low at least as long as the unemployment rate stays above 6.5%. XAU/USD tried to climb above the 1723 level, which coincides with the top line of the Ichimoku cloud on the daily chart, but immediately pulled back and created a long wick on the upside. It is no surprise to see a shooting star at this point as the clouds often acts as strong resistance (or support depending on its location).

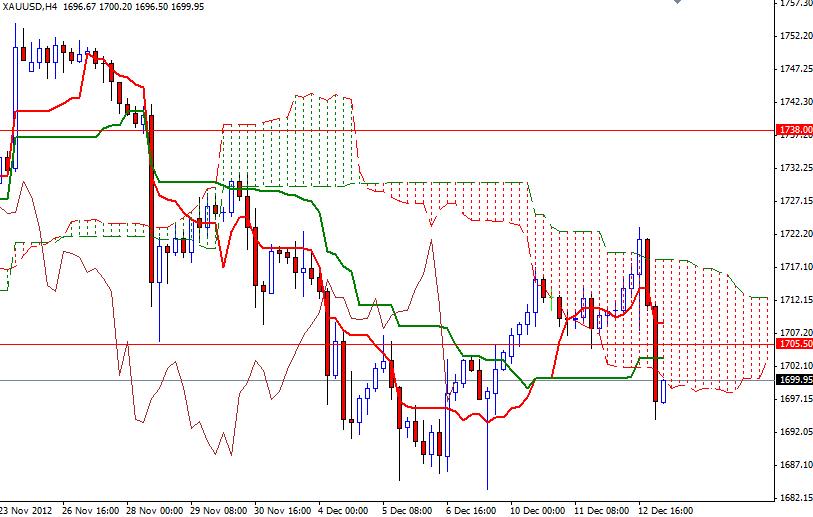

Although the pair paused its free fall at a strong support level of 1694, the general outlook turned bearish once again. Shooting start suggests XAU/USD found heavy resistance and the higher prices are rejected by investors. During the Asian session prices also dropped below the Ichimoku cloud on the 4-hour time frame. Today the key levels to watch will be the 1705.50 and 1694 levels. If prices manage to climb and hold above the 1700 level, we may see a bullish attempt to revisit the previous support at 1705.50 level. If the bulls win the fight and break above 1705.50, I think we may have a chance to reach the upper line of the cloud (4-hour chart) at 1716.

If the bears increase the selling pressure and drag prices below 1694, then 1685 and 1677 would be the next targets. Today, investors’ attention will turn to the budget battles in the United States.