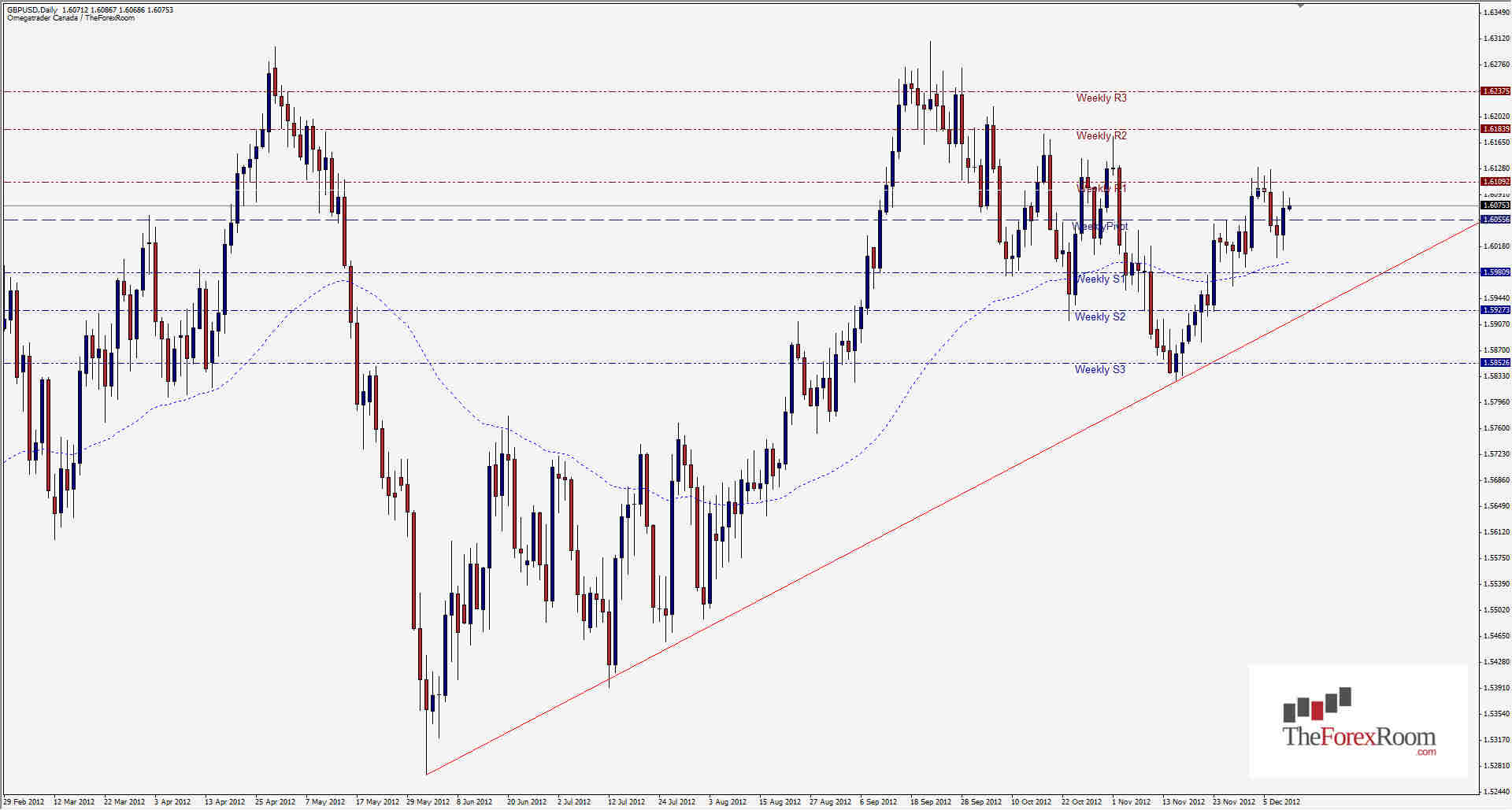

In a move that surprised many traders yesterday, the GBP/USD remains Bullish in spite of better than expected NFP numbers out of the US on Friday, and lackluster if not downright poor performance numbers across every news event for the Sterling last week including manufacturing production and services PMI. So is it risk on or risk off? This question will receive a different answer from any analyst you ask, so it is best to stick to what we see, rather than what we hear. In this case, we see that the last Weekly Candle was a Bearish Pin Bar, but that we have already reached and surpassed the 61.8% retracement level for last week's entire trading range. This indicates that if we break last week's high at 1.61303 we will be 'fading the tail' of that Weekly Pin Bar and as such see a good possibility of prices continuing to rise. Resistance is quite heavy above 1.6130 with the Weekly R2 at 1.6183 and the Weekly R3 at 1.6237. The 2012 high also sits at 1.6309, could this be where the GBP/USD is headed? Can we get there before the US announces whatever resolution they come up with regarding their 'Fiscal Cliff'? We don't have any major news for the GBP today, but we do have the US Trade Balance numbers later today, as well as Claimant Count Change and the FOMC Statement tomorrow which could have a huge impact on this pair. If prices fall, look for support at 1.6050, 1.5980 and a strong level of support at the Weekly S2 where an ascending trend-line intersects as well at 1.5920 +/-. The trend-line has held since establishing its anchor at the 2012 low of 1.5268, and without some catalyst, is likely to continue to hold until investors confidence in the all mighty greenback is restored.

GBP/USD Remains Bullish- Dec. 11, 2012

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- GBP/USD