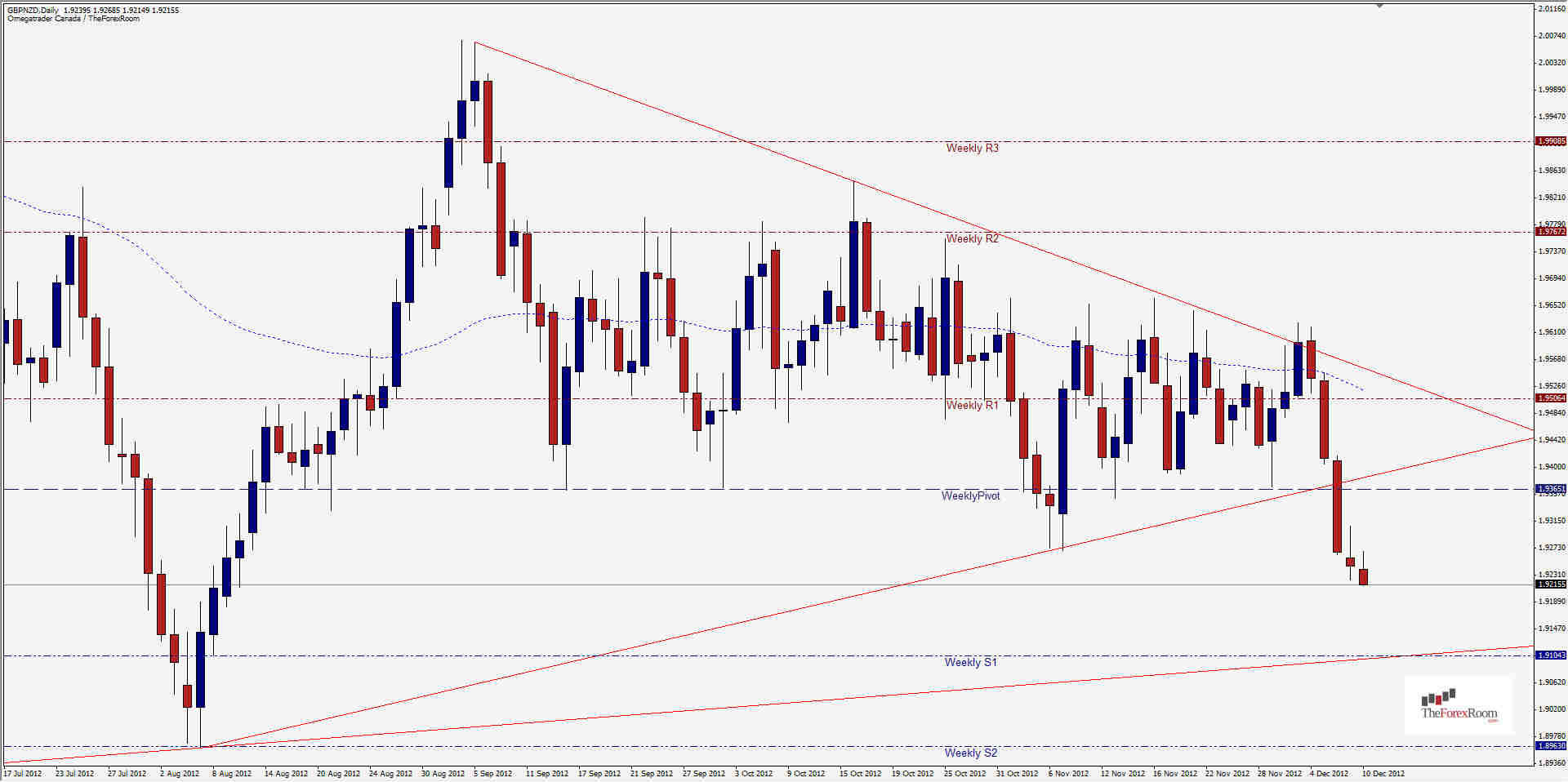

The Kiwi is performing quite well compared to the weakness of the Sterling in the past week. As a result the GBP/NZD has broken out of a triangle formation that has held the pair in check since August with continually higher lows and especially, lower highs. At just before 10AM in Tokyo we have already broken last week's low of 1.92238 with the NZD looking to break last week's high against the USD as well. For the GBP/NZD we have a clear shot down to at least the Weekly S1 of 1.9104, which also coincides with an ascending trend-line formed from the higher lows that have been set consistently since July 2011 when the pair reached an all time low of 1.8544. Intra-day support is really the only thing holding this pair up, with levels at 1.9210, 1.9175 & 1.9162 providing support prior to the weekly level mentioned earlier. On the flip side, should prices reverse and head back towards the bottom of the triangle, look for Intraday resistance at 1.9294, 1.9432 & 1.9378 with the Weekly Pivot sitting between the Daily R2 & R3 at 1.9365. This pair is extremely Bearish in my opinion, with all time frames from the Monthly on down looking for new lows. I see this pair falling to 1.9100 or 1.8950 to retest the 2012 low.

GBP/NZD Breaks Formation

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- GBP/NZD