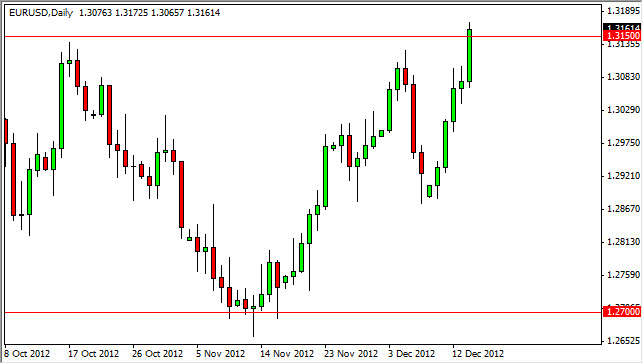

The EUR/USD pair had yet another strong showing on Friday as we managed to close above the 1.3150 resistance level. Granted, we only broken by about 15 pips, but this does suggest that we are going higher in the long run. There is a ton of noise above their though, so I'm not overly excited about going long of this pair at the moment. I think the best you can do will be to buy pullbacks show signs of support going forward.

On pullbacks, I think we will begin to see support build in the marketplace for the Euro going forward, and this is probably based more upon the Federal Reserve than anything else at the moment. After all, the Federal Reserve has stated that it was willing to extend its bond buyback program, as well as some of its other asset purchase scenarios. One thing that did stick out to me was the fact that we closed at the very top of the range, always a bullish sign.

The Federal Reserve and the "fiscal cliff."

Two of the biggest drivers of this pair are going to be the Federal Reserve and the so-called “fiscal cliff.” The Federal Reserve has agreed to extend its easing, and this of course will mean more printed Dollars. As the Federal Reserve buys more and more bonds, they simply throw more Dollars into the system, and unlike the latest easing policy, this is not "sterilized." In other words, they are flat out printing money.

The other driver of a bull market in this pair will be the “fiscal cliff.” If the debt negotiations don't go well, this could reverse that move rather rapidly as traders will scramble for some type of safety in the form of US treasuries. However, as long as things look like they are somewhat reasonably dealt with, this pair will continue much higher. My suspicion is that any selloff in this pair will simply be a buying opportunity in the end. After all, the market has forced Congress to act in the past, and my suspicion is that if they don't get it together soon - the markets will do so again. Predictably, Congress can suddenly get it together when forced to do it though. With that being said, I suspect that the drop would be a short-term move that would be reversed fairly quickly.