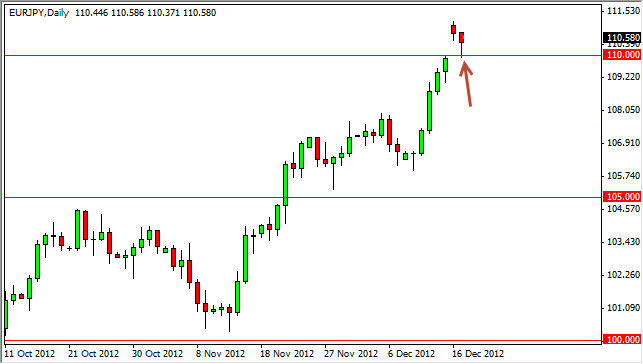

The EUR/JPY pair initially gapped as the markets opened for trading in Asia on Monday. Ironically, the highs for the session were put in just a few moments afterwards. This would've been predicated upon the LDP, or opposition party in Japan winning a "super majority" in the lower parliament that means they could impose their will and work around the upper house.

Because of this, is expected that the new Prime Minister, Mr. Shinzo Abe, will pressure the Bank of Japan into printing Yen as quickly as they possibly can. He is made several statements publicly that he wished to continue an aggressive policy of easing that was the hallmark of his first stint as PM.

Going forward, it is obvious that the markets are looking to sell the Yen. This could finally be the unwinding of the massive long Yen positions that have been put on over the last couple of years. This is seen in almost all Yen related pairs, and the EUR/JPY is of course no different. After all, you have the Euro which is experiencing a bit of a revival at the moment, and then you match it up with the Yen which is being sold off, you have the perfect recipe for a massive bullish move.

Gap filled, 110 the floor?

The shape of the candle for the Monday session is a perfect hammer, and this of course caught my attention as it was filling a gap. We have broken out above a major resistance area at 110, and as a result I think that this pair is about to take off to the upside.

With this being said, looking at the longer-term charts I believe that we can reach levels as high as 115 before it's all said and done, and I think that's where the market is heading. At 115, we see a massive resistance area based upon the monthly time frame, and the pair breaking out above this would indeed be a longer-term buy-and-hold situation just waiting to happen. As for selling, I have absolutely no interest in doing so at this point.