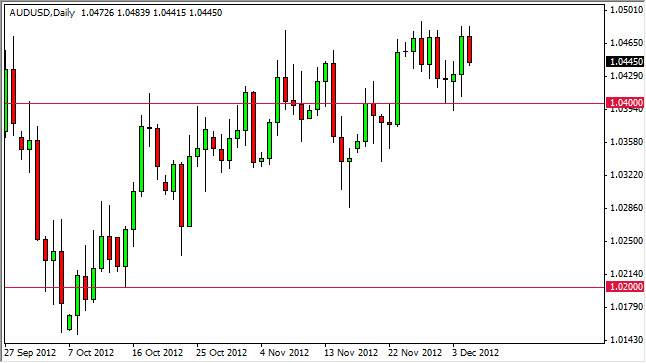

The AUD/USD continues to fall every time we reach the 1.0475 level, as shown during the Wednesday trading session. Because of this, it was no surprise that we got a pullback during the Wednesday session, and as a result I think we are simply tightening up this marketplace and waiting for some type of news. What could that news be you ask? Unfortunately it is what the U.S. Congress will be doing about the fiscal cliff situation in that country.

While many of you are not in the United States, you may think that it is only a matter time before they come up with a deal. This is probably true, but right now they look like they are very far apart on any type of negotiations. With this being the case, you have to ask in the markets will fall apart in order to punish Congress into doing something. This has been seen time and time again over the last four years, so there's no reason to think it can't happen now.

Consolidation

The spacing I personally believe the consolidation will be the order of the day for the short-term. However, if we get above the 1.0475 level we could see a run all the way up to the 1.06 level. It is above there that things get really interesting, as we could clear path all the way to the 1.10 level.

In the meantime though, it is going to take some type of headline Norway's to push the market in one direction or the other. Simply put, most traders are not willing to take on any significant amount of risk at this point in time as it is getting towards the close of the year. They have to show profits to their clients, and make a bonehead move at this point in the year certainly will not help that situation. Because of this, I think that we will see somewhat dampened moves over the next couple of weeks, but as we get towards the end of the month of December, liquidity will be drawn out of the market and we could see erratic moves at that point. This will be especially true if the morons in Washington DC can’t get it together.