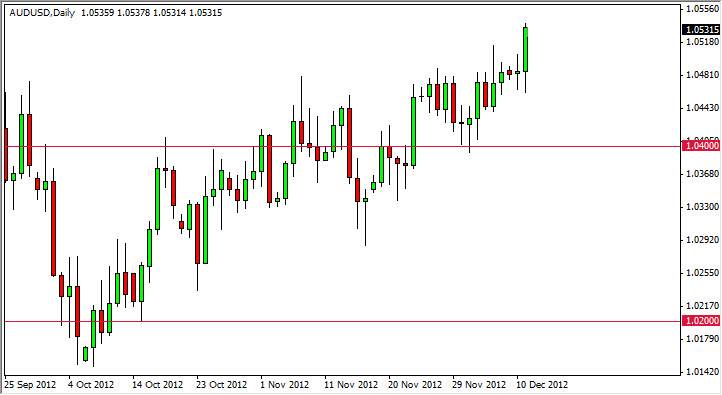

The AUD/USD pair had an extraordinarily bullish session on Tuesday as the 1.05 level has been overcome by the buyers. The market looks extremely bullish at this point in time, and as a result I firmly believe that we will test the 1.06 handle in the relatively near term. It is at the 1.06 level that I see the real test.

The 1.06 level is the top of a massive consolidation area between 1.02 and that level. Because of this, I think that a move above 1.06 really sets the Australian dollar free to rise as high as 1.08 and 1.10 in the next several months. It would make sense, and based upon the fact that today will see the Federal Reserve release the minutes of its FMOC meeting. There is quite a bit of speculation as to whether the Federal Reserve Chairman will announce that there is an expansion of quantitative easing, and if there is we will see the Australian dollar again as the US dollar loses value against most currencies.

Watch gold markets

One of the biggest indicators will be the gold markets during the trading day today. If the markets look at the action by the Federal Reserve is being altered dovish, gold market should take off. The Australian dollar has a long history of moving with the gold markets, and I do believe that the two will move in tandem based upon whatever reaction we get from the marketplace.

With all this being said, you can expect a fairly quiet morning all things being equal as the world will certainly be waiting on the Federal Reserve. The other side of the coin of course is we could possibly get some type of announcement from congressional leaders in the United States on a debt deal. This would be very bullish for all risk assets as well, and send markets higher.

As for selling the Australian dollar, I do not like doing so at this point time. I believe that pullbacks will simply offer buying opportunities, and I see a ton of support all the way down to the 1.03 level.