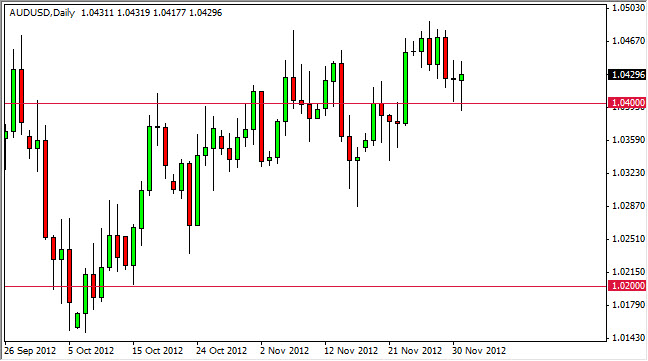

The AUD/USD pair fell during most of the session on Monday as the jitters involving the fiscal talks in the United States continue to put a bit of a weight around bullish attitude in the market. The Australian dollar is very risk sensitive, so this doesn't surprise me that we saw quite a bit of jostling during the session. However, we did see quite a bit of support at the 1.04 level, and as a result we get a nice bounce that formed a hammer for the session.

This hammer suggests to me that we will see a rise in value of the Australian dollar, and I feel that going forward we should see a bit of a "pop" in this currency pair. However, if we managed to break down below the 1.04 level this would of course be a very bearish sign.

If we managed to break above the highs from the Monday session, I would suggest that this market should attempt to reach the 1.0475 level, which is the next resistance area. It does look like a relatively strong area, so this could of course give the pair some trouble. However, above their it's clear sailing until we reach the 1.06 handle.

Watch the gold markets

Gold looks like it's trying to find a bit of a bid down near the $1700 an ounce level, and as a result we could see the Australian dollar follow suit. In a lot of ways, the 1.04 level looks a lot like $1700 in gold to me, as massive support and a clear "on/off switch” in both markets, and I believe that we are going to make this choice soon.

The markets will be susceptible to sudden headline noise in this environment, and because of this tight stops should be used. In fact, if you have the ability to use options I would as it can help limit some of the risk in what could suddenly be a massively volatile environment. Going forward, if we can get above the 1.06 level, this market should head towards 1.08, and the 1.10 before pulling back again.