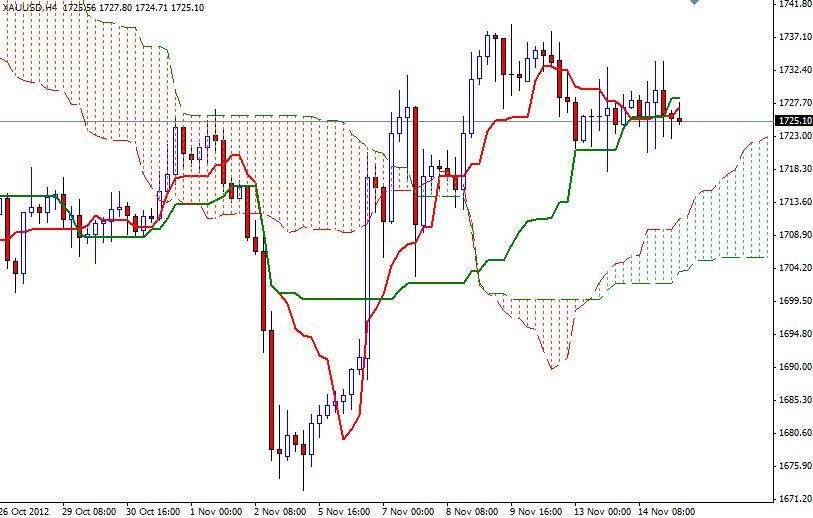

XAU/USD (gold) has been range bound since Friday. After yesterday’s choppy session, the pair looks like it is trying to wind up for a move as the range keeps getting tighter. 4-Hour chart shows the battle between the bulls and the bears intensified in the 1732 – 1720 zone. Some investors seeking to hedge against currency weakening continue to choose this precious metal to park their cash. Also developments in the Middle East increased demand for this precious metal. On the other hand, worries over Greece’s next bailout installation, uncertainty over whether Spain will seek a bailout and fears that growth in China was slowing remains supportive for the U.S. dollar. Therefore, the primary driver of gold prices in coming days looks likely to be the headlines from the United States. With this in mind, I expect CPI numbers and manufacturing data out of the U.S. today will have high impact on XAU/USD. For now the 1720 level looks supportive but 4-hour chart is turning bearish as Tenkan-sen line (nine-period moving average, red line) crossed below the Kijun-sen line (twenty six-day moving average, green line).

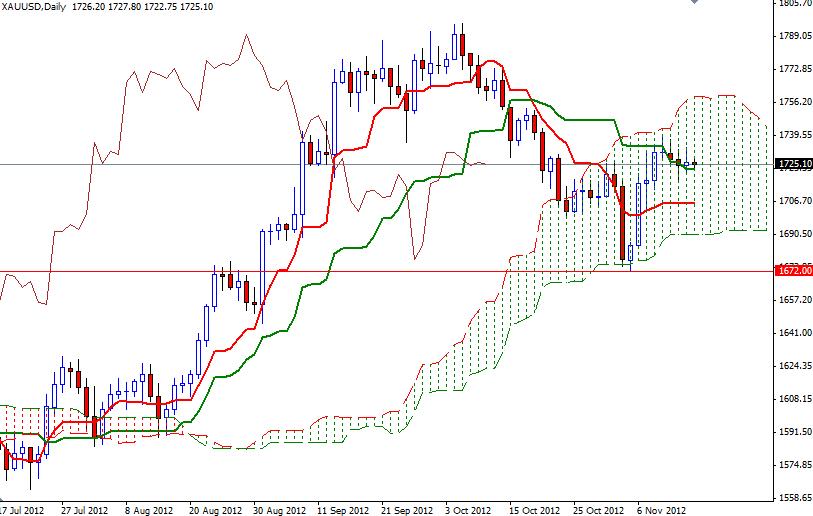

Prices are still trapped in the Ichimoku cloud on the daily chart, indicating that we will see the pair consolidating some more time. If the pair manages to hold above 1720 and the bulls increase the upward pressure, look for 1729, 1733 and 1736. If the 1720 level is breached, support to the downside can be found at 1717.90, 1715.30 and 1712.50.