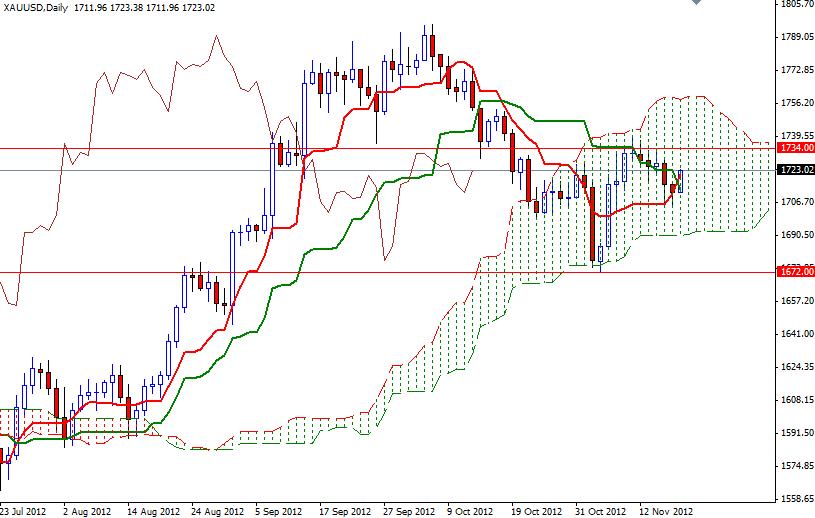

During lower volume Asian trading today gold (XAU/USD) turned bullish and is currently trading at 1723. Lately the biggest influence on the gold price is the ongoing uncertainty over the U.S. budget talks and therefore I expect the main element effecting gold prices in coming days will likely to be investors’ concern about the U.S. fiscal situation. Although the recent reports show that global gold demand fell in the third quarter, the precious metal should continue to strengthen in the longer time frame as several central banks around the world continue to ease monetary policy. On the daily time frame, XAU/USD remains trapped in the Ichimoku cloud but Tenkan-sen line (nine-period moving average, red line) is about to cross above the Kijun-sen line (twenty six-day moving average, green line), indicating the bulls are regaining strength.

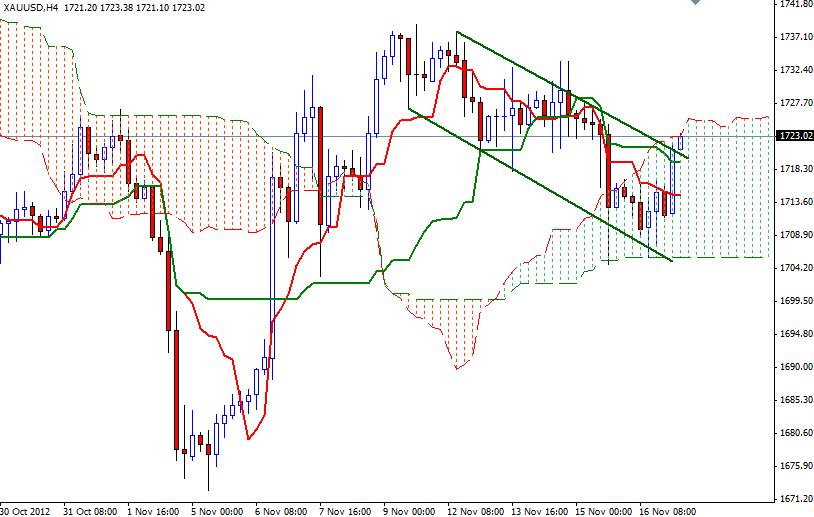

On the 4 hour time frame, XAU/USD pair is trying to break out of the descending channel which it has been running in since November 9. If price breaks through 1726, gold is likely to maintain bullish trend and head for a test of previous week’s high of 1738.90. On its way up, the bears will be waiting at 1730 and 1734. On a break above 1739, we would open up the door to 1750. If the bears win the fight and XAU/USD reverses, the 1715, 1710.30 and 1705.74 will all be potential support levels.