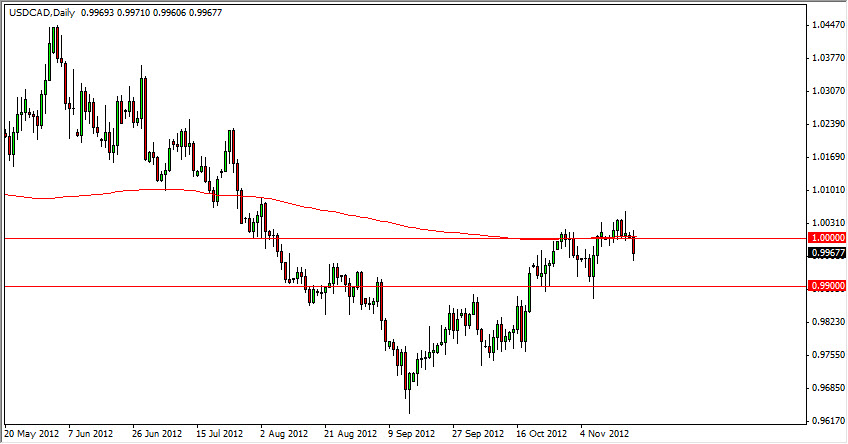

The USD/CAD pair has been one that has been in my sights for a while. After all, we got the breakout above 0.99 which should have shown that the markets wanted to get bullish overall. However, as you can see, there hasn’t exactly been a massive rally since then, and it now looks as if the range we are going to trade in is roughly between the parity level and the 0.99 handle. Because of this – I think this market is very tight. However, this pair can be traded, and especially if you are a short-term trader.

The scalpers are going to love this environment. After all, you have a 100 pip range that this pair wants to sit in, and the boundaries are very well defined. This is the perfect set up for scalping because of the fact that the boundaries are so well-defined, but also because of ability to set reasonable stop loss sizes as well.

Oil and the Middle East

Interestingly enough, even with the massive spike in the value of oil over the last few sessions, we still don’t see this pair falling at the moment. This leads us to believe that the market isn’t winding up for a larger move going forward.

The parity level being broken to the upside would have me interested in buying. However, a move above there would have to deal with the 1.0050 level in order to truly be broken out. This is because of the swing high that we see on this pair from just a little while back. The fact that we haven’t seen a spike in the value of the CAD while oil has done so well is certainly a sign that the CAD could be in trouble in general.

The breaking below of the 0.99 level would have us selling this pair in droves as the oil markets would more than likely signal a move lower by spiking simultaneously. This doesn’t have to happen of course, but a combination of both would be very bearish for this market indeed as the markets would be running from the Dollar in reaction.