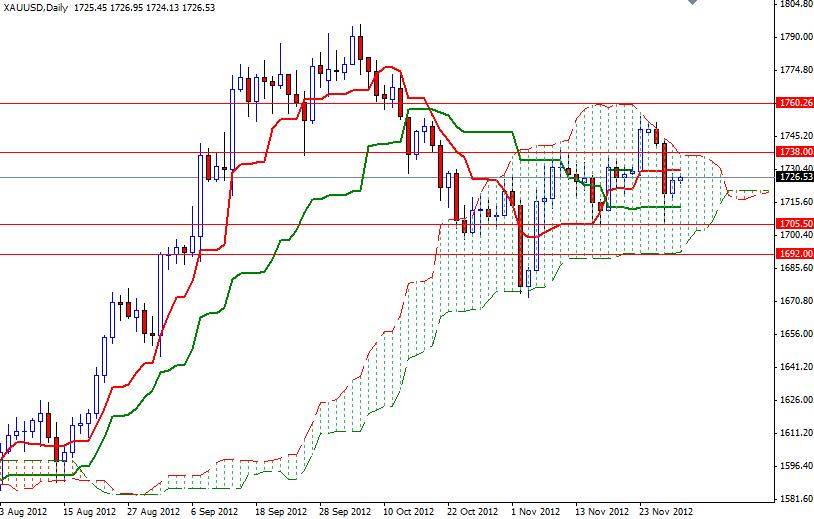

XAU/USD recovered some of Wednesday’s losses after John Boehner, the speaker of the U.S. House of Representatives, said “Despite the claims that the president supports a balanced approach, the Democrats have yet to get serious about real spending cuts. Without serious discussion of spending cuts, there is a real danger of going off the fiscal cliff”. Conflicting messages from American lawmakers increased level of uncertainty in the market. Comments from Federal Open Market Committee vice chairman William C. Dudley also helped provide a lift to gold. Considering that the Fed will keep interest rates low for a long time and continue printing money, I think the long term fundamentals will favor gold. Today investors will turn their attention to data from the eurozone (German retail sales and French consumer spending). Pattern on the daily chart indicates that XAU/USD is going to climb to test the Tenkan-sen line (nine-period moving average, red line) which currently sits at 1730.03.

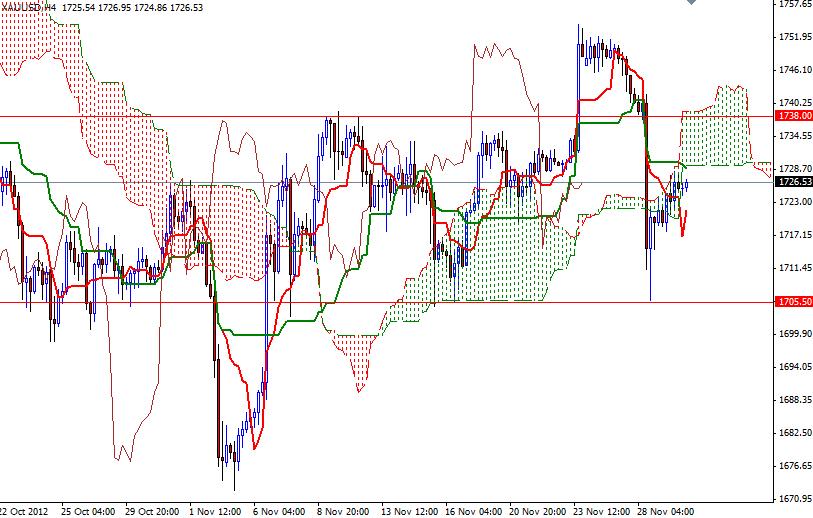

This level also converges with the bottom line of the Ichimoku cloud (4-hour chart). I think this level will be the key for a bullish continuation. If prices climb and hold above the 1730.03 resistance level, the bulls will gather enough strength to challenge the top of the Ichimoku cloud (daily time frame) at 1737.76. On its way up, there will be resistance at 1733.90. A close above 1738 would open the door for 1760. However, if the bulls encounter heavy resistance and retreats, expect to see support at 1724.30, 1717.12 and 1710.