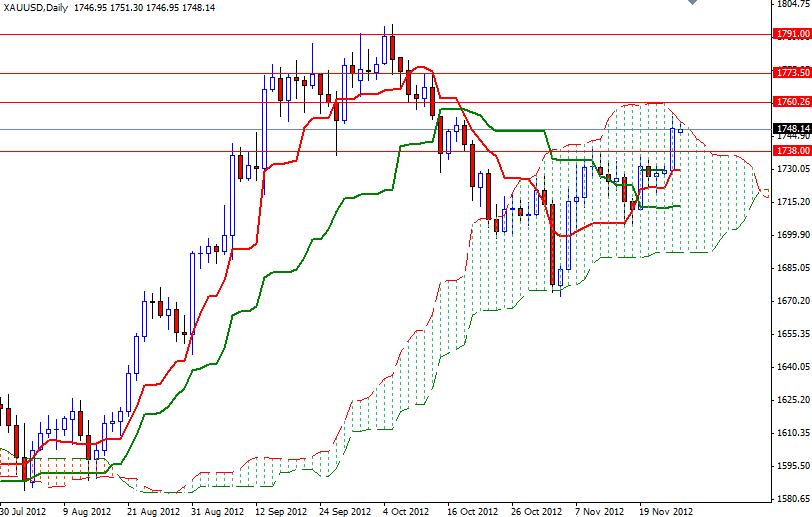

XAU/USD rallied last week on expectations eurozone chiefs will finally reach an agreement on Greek aid. Stronger-than-expected business climate data from Germany was another supporting element for gold prices. Numbers released from the Ifo Institute said its business climate index rose to 101.4 in November from 100 in October. With American politicians returning from a Thanksgiving break this week, debates on the U.S. budget may be the primary driver of gold prices in coming days. Aside from the U.S. budget negotiations, investors will also be focused on series of data on U.S. housing market and consumer confidence. Since gold often drops on the dollar’s strength, these data may have high impact on XAU/USD as well. I think the weekly range will be between 1738 and 1773. On the daily charts there is a pattern we often see since August. Prices climb fast and pause for a few days and continue to rise again. It appears this pattern is back since the pair finished its retracement at 1762.58. I think XAU/USD will remain bullish as long as we trade above the 1738 level.

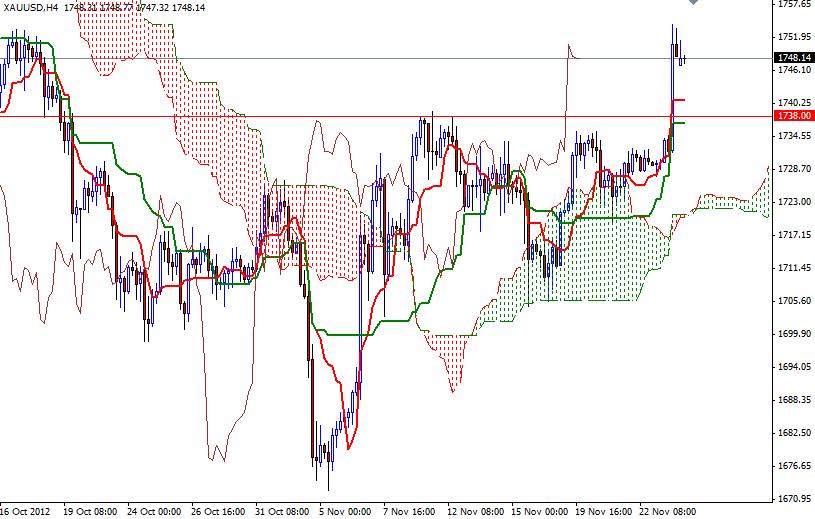

The 4hour chart shows the pair is extremely bullish; prices are above the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) is above the Kijun-sen line (twenty six-day moving average, green line). Also Chikou span (brown line) indicates the higher prices will come.

The pair will more than likely find a reason to rally and try to break through 1750 resistance again. If we can break above Friday’s high, XAU/USD will be heading towards 1773.50. On its way up, expect to see some resistance at 1760 and 1767. However, if the pair fails to climb above the cloud on the daily chart, we may see a pull back to the 1738 level. Below 1738, there will be additional support at 1729.52 and 1720.27.