XAU/USD (gold vs. the American dollar) looks like it is getting tight again, and as such it will be difficult to trade in the near term. Although finance ministers reached agreement on new debt targets for Greece and a political agreement on disbursing the next installment of aid, the market’s response was limited. The deal was already priced in and there is an important fact that economic situation in Europe is getting worse and the latest agreement doesn’t offer a fundamental resolution to the eurozone's debt crisis. However, between the fiscal cliff, Fed’s unlimited money printing, tension in the middle east and the mess in Europe, gold will be supported. According to the Commodity Futures Trading Commission's weekly report on the commitments of traders, speculative traders continue to increase their open long gold positions. Now investors will start focusing on the U.S. budget negotiations and high impact economic data.

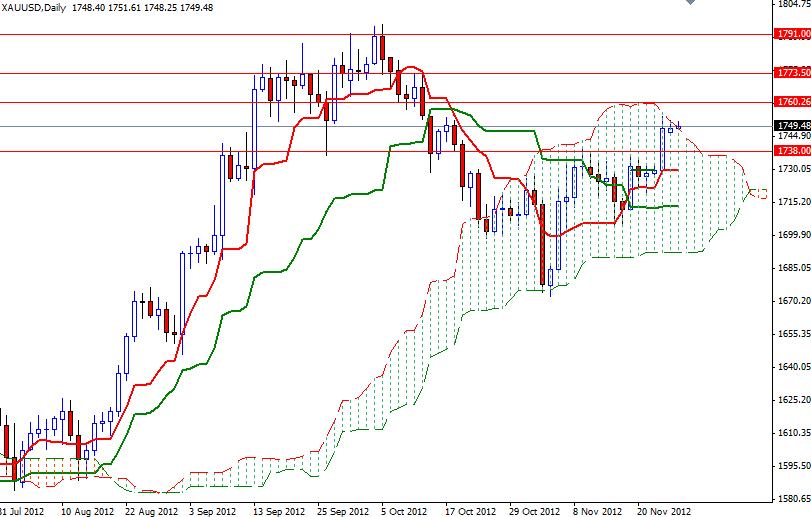

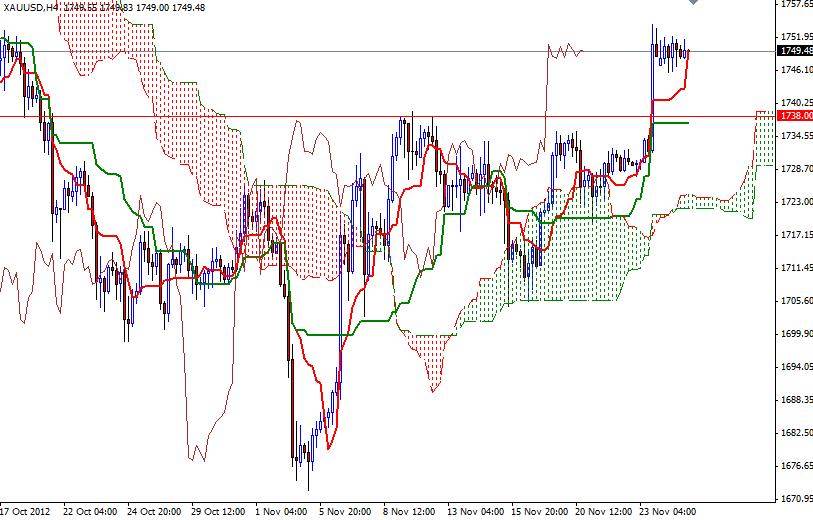

On the daily time frame, prices are about to leave the Ichimoku cloud behind to test the 1760 level and 4hour chart indicates the bulls are stronger than the bears but the price pattern that gold follows since August suggests we may pull back to 1738 before the bulls start a new rally. Today’s key levels to watch will be 1745 and 1755. If the bulls break through 1755, look for 1760, 1767 and 1773.50. If the bears win the fight and prices falls below 1745, look for 1738, 1729.52 and 1720.27.