The EUR/JPY pair is very risk sensitive. The pair will literally rise and fall with risk sentiment, and as long as the market continues to suffer from headline risks, this pair will remain vulnerable.

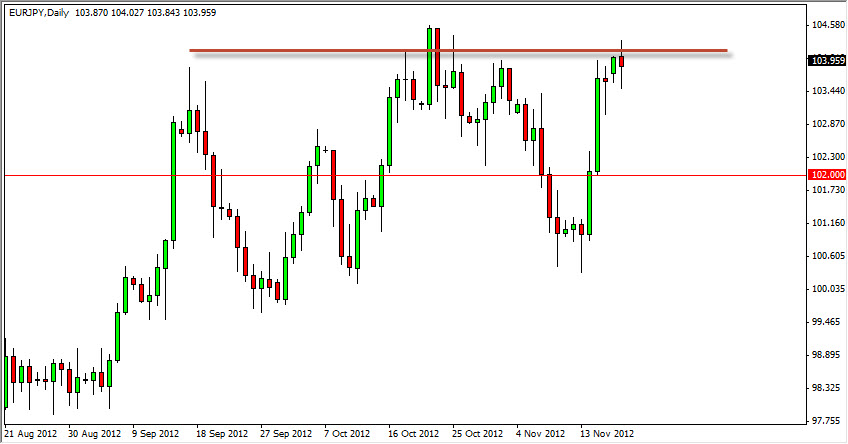

The pair has run into a bit of resistance at the 104 level, and as you can see from the chart the area is significant for the bulls in their quest to push prices higher. However, there are a lot of reasons not to own this market, and as a result I am very conservative on the long side of this pair.

The recent action has the market bouncing up to the bottom of a trend line that the markets had been following previously. This “retest” of the support as resistance is typical, and suggests that we will see lower prices sooner rather than later. The headlines certainly are going to be full of potential problems, and many of them are going to be in Europe itself.

“Hanging man?”

The candle for the Monday session looks like a hammer, but at the top of a rally. This area should be either a supportive level, or perhaps if the candle gets broken to the downside, this would be a very negative sign. With this being the case, we would consider selling if that happen, and would try to ride it all the way down to the 100 level.

The Bank of Japan is working against the value of the Yen at the same time, and as a result this pair will be somewhat lifted going forward. The central bank is likely to begin to print “unlimited Yen” in order to help the export economy out.

The European Union has a lot of problems at the moment, and many of them are going to be structural in nature. In other words, this pair will continue to bounce around while the Americans are working (or not) towards a “fiscal cliff” resolution. I believe that if we cannot break above the 104.50 level, we will certainly fall back to the 100 level as the longer-term sideways move continues.