By: DailyForex.com

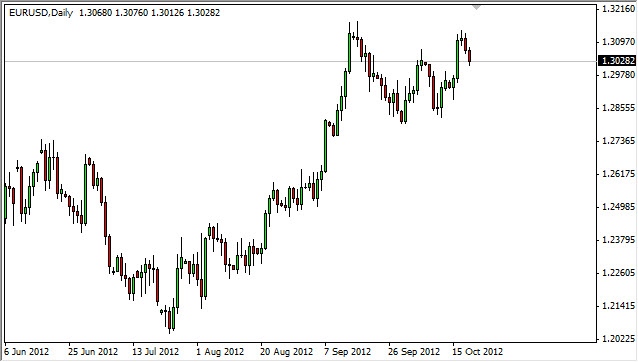

The EUR/USD pair pullback on Friday after looking like it made a double top. Question then will remain whether or not we can get a "higher high", or is this the top? It's hard to tell this point time, but it is hard for me not to notice that the 1.30 level and above gives this pair a lot of trouble right now.

Looking at the longer-term charts, it is obvious that 1.30 is the beginning of about 500 pips of noise. Because of this, I do not like buying this pair, although I can definitely see a case as to why. After all, this pair has gone straight up over the last couple months, and has only recently begun to struggle.

It also appears obvious that the 1.28 level looks to be supportive, and because of this I think that consolidation is probably the way forward in the immediate future. This pair will be prone to have sudden headline related moves. Without a doubt, the biggest headline will involve Spain and whether or not it wants to receive a bailout. The markets have been anticipating the Spanish coming and asking for it, but they have refused to do so at this point. If they do, this will be very strong for risk appetite in general, and by extension the Euro.

Longer-term Effects of the Bailout

The bailout would of course be good news for a lot of banks in Europe, and money would probably come flooding back into the markets. However, over the long term this would essentially be the same thing as printing Euros out of thin air, and as such it should continue to weaken the Euro down the road. There will be an initial relief rally, but eventually supply and demand will certainly come into play.

In the meantime, I believe that we are stuck between 1.3150 and 1.28 or so. Because of this, I feel there is more downside than upside at the moment. However, it until we get below the 1.28 on a daily close, I will be trading the short-term only.