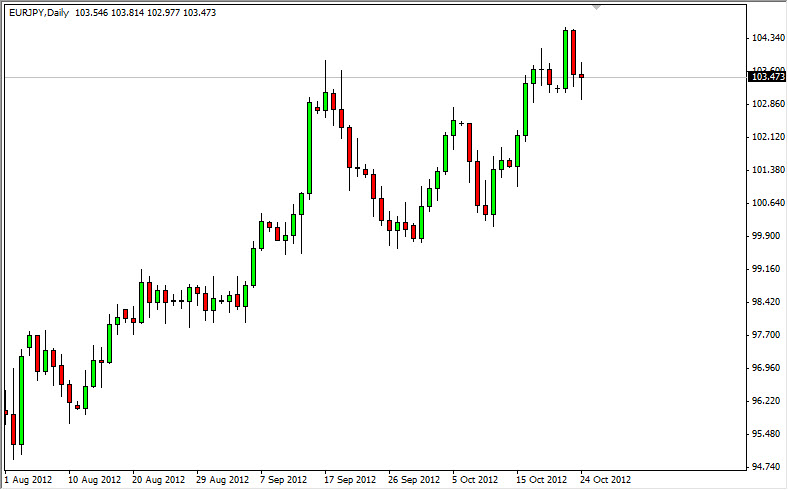

The EUR/JPY pair fell during the session on Wednesday in order to break through the 103.50 level. However, by the end of the session we saw the pair bounced off of what seems to be obvious support, and it suddenly formed a hammer.

While I don't like the Euro in general, I have to admit that this is the one pair that I have been fairly clear about being bullish on. I think this is an anti-Yen play more than anything else. The Bank of Japan will more than likely introduce some type of easing in the near-term, and as such it should help to weaken the value of the currency. It doesn't really matter what is pushing this pair in the end, as it is obviously broken out to the upside, and finding support at what was once resistance. This is very basic technical analysis, and I never argue with it.

108

If we can get above the 104 level on a consistent basis, I see that this market could very easily find 108 handle before it is done moving higher. This is based upon the fact that there is very little resistance, and I see hardly any cluster between here and there. It may seem like a heady goal, but let's look at where the market has been over the last several years: This pair used to go straight up like a freight train on a daily basis. In fact, traders quite often like owning the Euro over the Yen.

This is generally a sign of a nice strong "risk on" type of marketplace. As there seems to be a bit of a selloff recently and I cannot help but notice that this market has held up relatively well. Stock markets have fallen, but this one is simply sat still. Because of this, I think that this market does indeed rise over time and on a break of the highs from the Wednesday session I would take is classic technical analysis signal in start buying this pair. As for selling, I really don't have a plan to, unless we break below the 102.50 level.