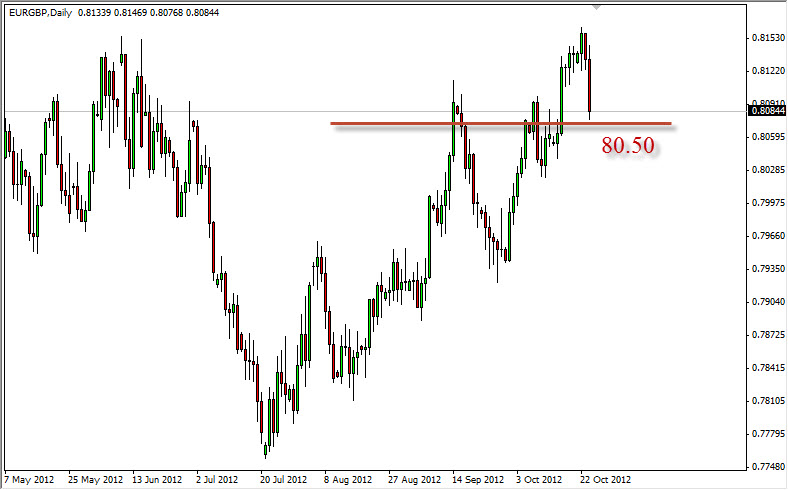

The EUR/GBP fell rather hard during the Wednesday session as we went as low as the 0.8075 level. When I look at this chart, I see that the 0.8050 area is support from the previous resistance, and as such this pullback really doesn't change my opinion on the whole.

When I look at this chart, I see two currencies that are generally going well, and as such it always makes for choppy trading. The two economies are intertwined in an almost unlimited amount of ways, and as such this pair is quite choppy in general. It's probably one of my least favorite pairs to trade most of the time, just simply because it doesn't move very fast. However, I should quantify that with saying that the pit value is much higher in this pair.

However, I see this is a potential long at this point. We are in an area that should show some signs of support, and if we get that supportive candle, I am not hesitating to start buying. The Euro has been on a massive relief rally in general, and I think this could continue. This probably has very little to do with the British pound, and probably more to do with the Euro. When you look at the Euro against other currencies, it formed hammers across the board for the Wednesday session. This is almost always a dead giveaway as to which direction the market will go the next day.

0.82 is the key

If I see the market rise above the 0.82 handle, I think eventually time we could see serious bullish action. Until we get above that level, it will be choppy, but it can't be denied that it has been rather bullish as of late. I would definitely feel more comfortable going long than short this pair, and I absolutely hate the Euro if that tells you anything.

If the Spanish finally asked for some type of bailout, expect this pair to absolutely spike through the roof. This is because there would be a massive relief rally as it would signify that many of the lenders around the European Union would suddenly find themselves whole. If this happens, I would go long the Euro against almost everything, at least for the short-term.