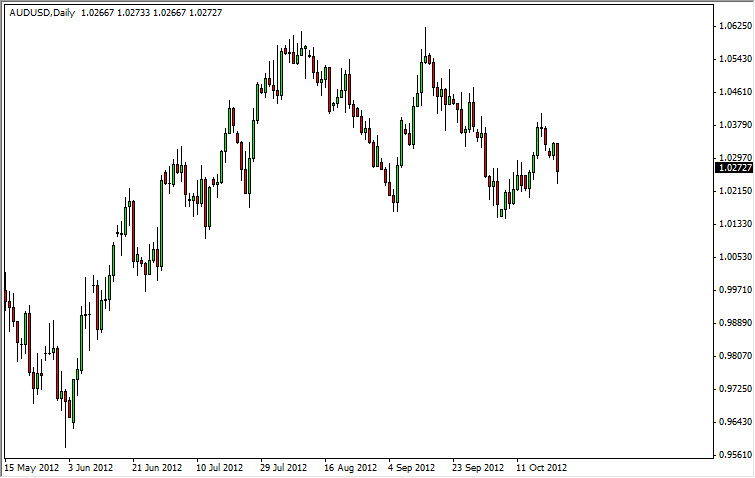

The AUD/USD pair had an extremely bearish session during the Tuesday trading day, and I believe that we are starting to see a serious surge in downward pressure in this currency. What catches my attention the most is the fact that we did not return to the top of the consolidation range at 1.06 the last time we bounce from the lows. In fact, we fell short at roughly the halfway point between the bottom and the top, and formed a shooting star.

Since then time, we have fallen over the course of the last several days, and smashed into the 1.0250 support level. Right now, I see the 1.0150 level as being crucial for the buyers. If we can break below that, this pair could fall rather precipitously.

Parity doesn't hold the same allure that once did as we have slice through it several times. If we break down, sure there will be some type of reaction at that level, but the reality is that it's old news. This is why I'm not afraid to take a short above that obvious level, and do believe that over time we will more than likely grind lower.

China and the housing bubble

The Reserve Bank of Australia has made it clear that they plan on cutting interest rates in the near-term. Part of this is because Australia is flirting with a housing bubble much like the United States had, but had been insulated against it because of their commodity exporter status. However, the Chinese economy has shown signs of slowing down, and this would be bad news for the Australian economy as the Chinese are by far their largest customer.

Because of the issues laid out in the previous paragraph, I am very bearish of the Australian dollar on the whole. Now it is simply a matter of timing, which is always the case we are dealing with the leveraged financial instrument. Nonetheless, I have the attitude of selling this pair as long as we are below 1.04 on the rallies, and of course selling if we break down below the 1.0150 level.