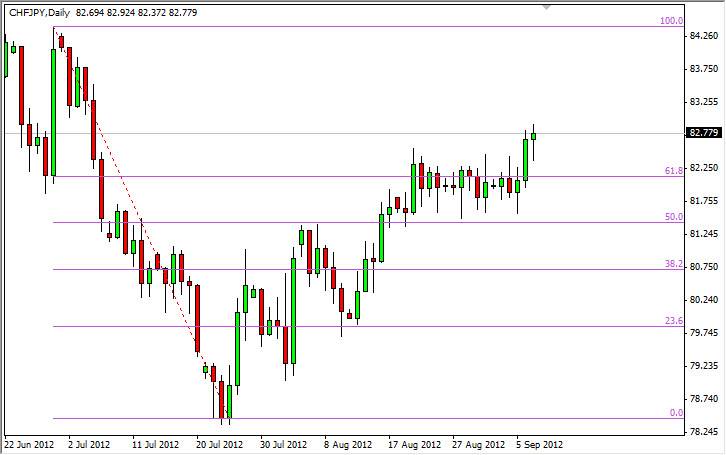

The CHF/JPY pair fell during much of the session on Friday, only to turn around and bounce. This bounce produced a nice looking hammer, and it should be noted that the hammers bottom is sitting on top of a nice supportive area that stretches over the course of two weeks.

This market essentially looks like the Swiss franc is supported at the 82 level, going all the way up to the 82.50 handle. This is interesting, considering both of these are considered "safe haven" currencies, and the Yen looks to be weakening. This is a simple continuation of the move that we've seen since late July in this currency pair, and we are now clearly above the 61.8 Fibonacci retracement level.

As long as the Swiss National Bank continues to try and work against the value of the Franc, it's hard to believe that this pair will easily fall. The chart looks like its clear and easy sailing for the buyers up to the 84.50 level, and as such I will be buying this currency pair on a break of the highs from the Friday session.

Hammer or “Hanging man?”

Right now, this daily candle for Friday could be either a hammer or a "hanging man." However, my personal belief is that if markets fall below the bottom of this candle and therefore technically make it a "hanging man", there is far too much support over the last two weeks for this pair to fall far.

It is because of this that I believe this pair is going to go higher and the fact that there seems to be very little resistance above. With this in mind, I think this trade should be good for at least 150 pips, if not more. Also, if the 84.5 0 Level Gives Way, we have retraced the entire move in this is always a bullish sign.

Looking forward, I think that this pair should continue to enjoy bullish momentum, but you must remember that it isn't exactly a volatile one. In other words, this pair could grind its way in one direction or the other overall. This is more of an investment rather than a trade when you are looking at the CHF/JPY pair sometimes.