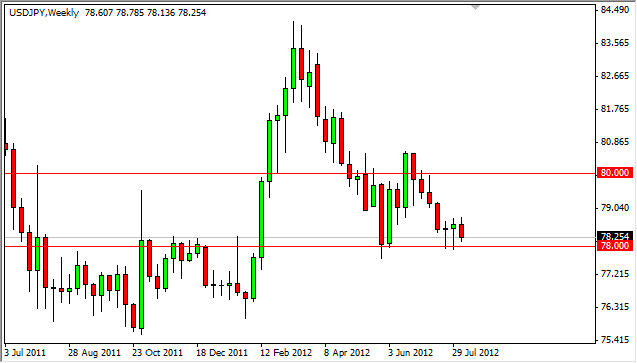

EUR/USD

The EUR/USD pair continued to show weakness during the previous week, and there isn’t much on this chart that has me thinking that the momentum is about to turn for the bulls for any real length of time. Because of this, I look at this market from a “Where can I sell it” perspective. I believe that the 1.25 level should continue to be a bit of a ceiling in this pair, and that we are heading to the 1.20 level before long. With this in mind, I am selling rallies.

EUR/GBP

The EUR/GBP pair is an even clearer case of Euro weakness. And when you think about it, why shouldn’t it be? After all, the GBP has shown a remarkable amount of resilience as it continues to press against the massive resistance area at 1.57 against the Dollar. Meanwhile, we have nothing but dawdling and bad headlines coming out of Europe. The Pound should be rising in value, should it not? With this in mind, I am selling rallies and fresh lows in this pair.

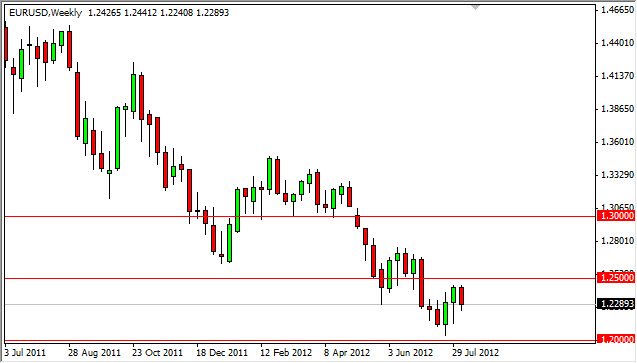

AUD/USD

The Aussie has enjoyed massive strength over the last several months, and has even managed to break above the 1.05 level. The area was retested for support this previous week, and we now look set to continue higher. In fact, the 1.05 could be forming a floor in the market at the moment. The 1.08 level appears to be the next stop, and I think that a break above last week’s highs signals that move. The pair tends to extend itself greatly over time, and that is exactly what we are doing now. As for selling, I am not considering it until we are below the 1.03 level.

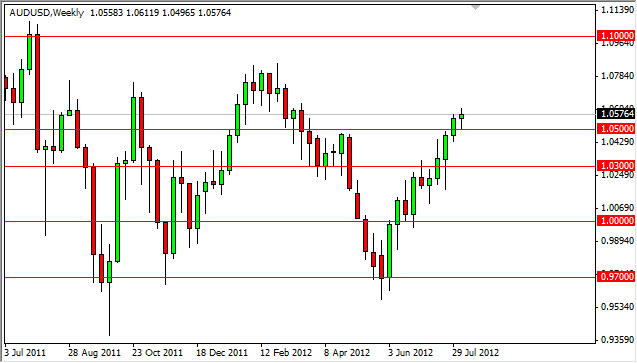

USD/JPY

The USD/JPY pair fell for the week again, and for the first time in three weeks – it didn’t form a hammer. However, it did manage to form a higher low. So now we have to ask whether or not we are seeing a bit of a bid come back into the markets for this pair. At the moment, it is probably far too early to tell. However, I can plainly see that the 78 handle is supportive, and as such I am willing to go long at this point. The Bank of Japan should be a bit of a backstop at this point in time as it is working against the value of the Yen.