NZD/USD had an interesting session on Tuesday as the participants in the currency markets have decided to place their bets ahead of the Federal Reserve and the European Central Bank meetings this week. Also of interest is the jobs number that comes out United States on Friday, which of course always moves the markets.

The reason the Kiwi interests me right now is that it is such a strong barometer for the risk appetite of the trading community on the whole. What I found interesting was that although we initially broke down during the Tuesday session, we could not keep our gains. This to me suggests that the market isn't willing to get too aggressive in one direction or the other before the central bank meetings, which of course is par for the course so to speak.

However, on top of everything else is the fact that the bullish traders simply wouldn't hang onto the "risk on trade.” I have to admit that this set up some red flags, as just a few days ago it seemed everybody was calling for the Federal Reserve to ease. We all know that the European Central Bank is going to do something, and whatever that is will more than likely involve easing. This of course should work against the value of the Euro, but we have to ask whether or not the Kiwi is suggesting that perhaps the markets about to be disappointed.

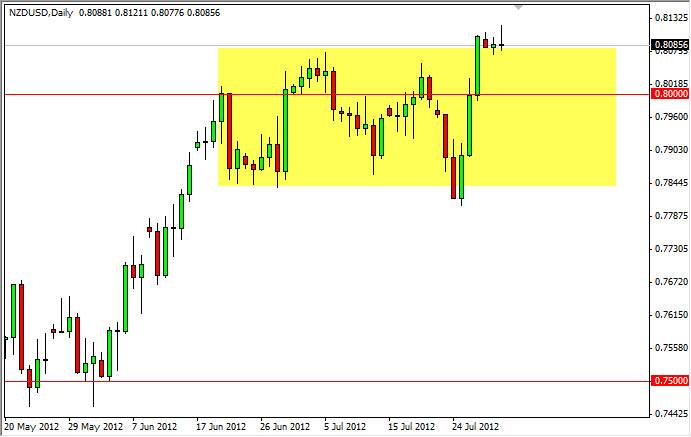

Shooting Star at 0.81

The shooting star for Tuesday's trading session is a very interesting one indeed. The last week of trading has seen a massive surge in Kiwi buying, and perhaps now the market is starting to have second thoughts. This shows me that there is a serious possibility that this bullishness was simple short covering. If the market was still overly bullish of risk in general, you would have to think that continuation would've happened. At the very least, we wouldn't have reversal candles.

Granted, this analysis will all depend on whether or not the Federal Reserve and the European Central Bank disappoint, but the fact is the ECB has a long history of doing just that. I think the next 100 pips in this pair are going to be very easily won. On a break of the top of the shooting star, this would be massively bullish and I will be buying. On a break of the bottom of the shooting star, I believe that we are heading back to the 0.80 level to search for support. Depending on which way we go, I will be taking the appropriate trade.