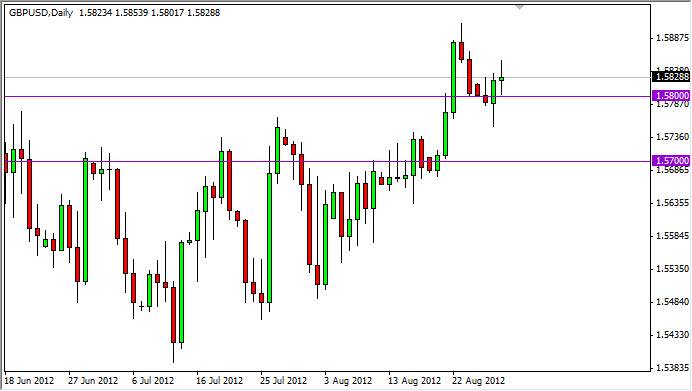

GBP/USD had a very volatile session on Wednesday as the markets simply went nowhere in the end. At the close, we were fairly unchanged and it appears that the market is currently waiting. This can be said for many of the currency pairs and other financial markets at this moment in time, and I believe it of course revolves around the speech that the Federal Reserve Chairman will be giving at Jackson Hole on Friday.

After all, this is a pair that has seen the head of the Bank of England, Mr. Mervyn King, state that the monetary policy of the Bank of England was "just about where it needs to be." Contrast this with the market expectations of more quantitative easing out of the United States, and of course it makes sense that the British pound would continue to climb against the Greenback. Because of this, the fact that we are sitting just above the 1.58 level is absolutely no surprise to me.

Depending on what the markets read out of Mr. Bernanke’s speech, we could see this pair absolutely take off. After all, the pair is currently sitting on the former resistance area of a nice large ascending triangle, and as such this is a perfect spot for other traders who missed out on the move higher to get involved.

1.63?

The ascending triangle from the summer measured a move all the way to the 1.63 level, and as long as we can stay above 1.57 - which I see as the bottom of this big "zone", I think we will see that target reached. Again, it's very likely that the Chairman speech could be the catalyst.

If he does in fact offer hope of more quantitative easing, this pair should continue to grind much higher as it makes sense that the British pound would continue to gain as the interest rate differential would still be in its favor, and possibly even gaining depending on what the bond markets and that doing. As for selling this market, if we end up closing below the 1.5650 level, I am more than happy to start selling as it would market a "false breakout", which is a very negative sign. Nonetheless, I feel that the move will present itself late Friday afternoon.