USD/CAD

The USD/CAD pair initially rose for the week, but managed to fall apart as the oil markets got a major boost during the Friday session. The pair now sits on top of the 1.0150 level of support, and looks vulnerable to the downside. The parity level below could be the target, and a breaking of the previous week’s lows would be the trigger to start selling.

That the oil markets will be crucial for direction, and the light sweet crude it breaking above the $85 level will be more than enough to propel this pair lower. As for buying, it's going to be very difficult to do until we see some type of supportive candle.

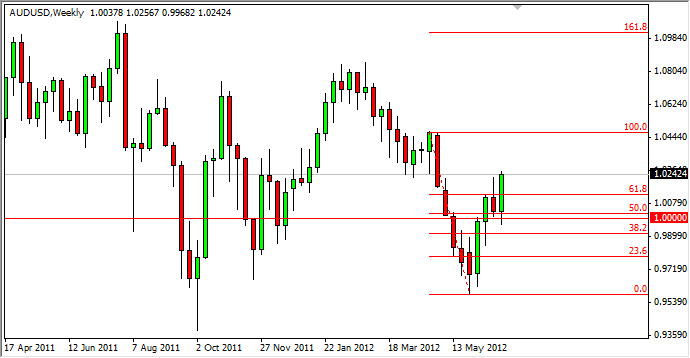

AUD/USD

The AUD/USD pair rose during the week as the "risk on" trade came into play. More importantly, the Aussie managed to break above the top of the shooting star from the previous week. This is a very bullish sign, but we need to overcome the 1.0250 level in order to confirm the move higher. My suspicion is that the Monday open in Asia will determine whether or not this will happen. A gap higher is very possible, and would have me buying this pair right away. On the other hand, if there are any bad headlines out of Europe involving this supposed solution, this pair will absolutely fall apart.

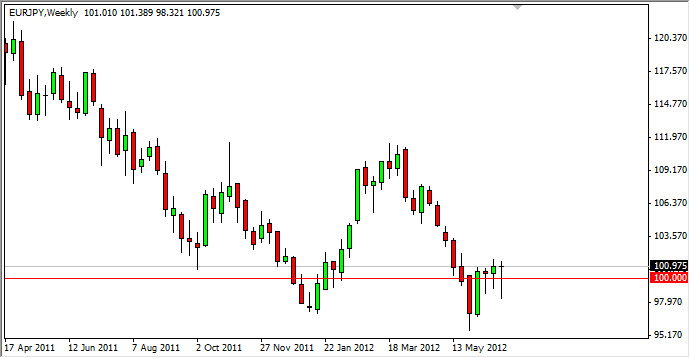

EUR/JPY

The EUR/JPY pair had an extremely interesting week as it initially fell for most of the week. However, at the end of the Friday session we had formed a perfect hammer right at the 100 level. On a break higher, and this could be a gap up on the Monday session, we think this pair will make a run eventually to the 105 level. As for selling, three hammers in a row on the weekly chart would keep me from doing this.

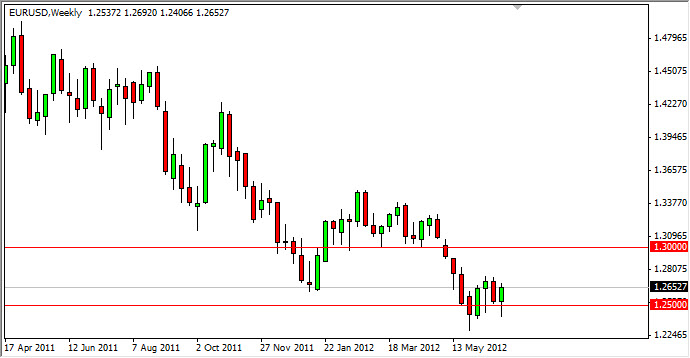

EUR/USD

The EUR/USD pair initially fell during the week as the concerns over the European Union continued. There was very little in the way of expectations for the meeting, so when a stepping stone of sorts came about, the markets got very excited. The real questions could be whether or not it was short covering, or a real burst of positive sentiment. Monday's opening could very well be a gap higher, and that would be interesting enough to have is aiming for the 1.30 level in my opinion. However, if the details come out of Europe for this "solution" in the markets don't like them, this pair will absolutely crater.