The USD/JPY pair had a positive session on Tuesday, and this would be expected during the session like we had on Tuesday as the Federal Reserve Chairman gave no real straightforward indication of looming quantitative easing. Remember, this pair is a struggle between two central banks of the world sees as racing towards the bottom when it comes to the value of the currencies. Both central banks have been active in easing monetary policy over the last couple of years, and now the question for the markets is which one will continue or even strengthen their easing policies.

It is a well-known quantity that the Bank of Japan is very active when it comes to weakening the Yen. Recently, they increased asset purchases by 10 trillion Yen in an effort to weaken their currency. However, the Federal Reserve Chairman Mr. Bernanke was heard stating that further easing was a possibility the very next day, and this completely wiped out the selling of the Yen from the asset purchase announcement.

When we went into the congressional hearings, there was a large chunk of the trading public that believed the Chairman was about to give hands that the Federal Reserve was ready to start easing again. The fact that he didn't, would've had traders looking at this pair as one currency that is definitely going to be used in the form of the Japanese yen, and another one that's suddenly uncertain. In a situation like this, of course the US dollar would gain.

Long-term trade forming

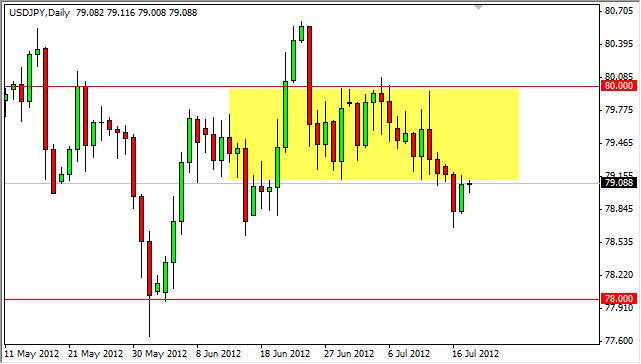

It takes a special kind of nerve to state and public that you think this pair is a long-term buy-and-hold. I'm not quite ready to say that yet, but to me I see a couple of very important levels that suggest we are going higher if we can break above them. The first one is the 80 handle, and I believe that if we can break out of that we will certainly test the 80.60 level that I find as a trading signal to buy-and-hold this pair if we can break above it.

On a move above that level, I believe the 84 handle will be hit eventually and it is at that level that we settle the question about trend. If we can get above the 84 handle, I suspect that this will become a long-term buy-and-hold that will run for months, if not years.

On the other hand, I do not think that the selling of this pair is possible at this point. Quite frankly, with the Bank of Japan being so active, I would be very nervous being short of this pair below these current levels. This is especially true when we get to the 78 handle, as it has proven so supportive recently, and the Bank of Japan will more than likely be willing to make a stand at that point. In other words, I am only buying this pair but waiting for the right signal. The area just above should be further consolidation, and although one certainly could buy at this point in time, I suspect that it will be much easier traveling once we clear the 80 handle.