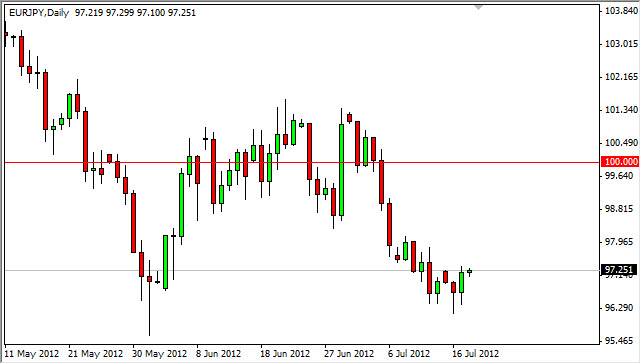

EUR/JPY had a positive session on Tuesday, as the Federal Reserve chairman spoke before the U.S. Congress. While this pair typically will follow equity markets, and risk appetite in general, it should be noted that we have also reached a major bottom in this pair and could be seen a simple technical bounce.

While the day wasn't necessarily horrible for equity markets, the general risk appetite was weak for most of the session. Normally, this means that this pair would fall. However, with the hammer that was formed late in May, I believe that the support in the general vicinity is very strong. Also, if you look at the hammer that was formed on Monday, this should have tipped you off as to the likelihood of support in the neighborhood as well.

Now with the top of the hammer from Monday has been triggered as price moved above it, many traders will be long of this pair at the moment. For myself, I am a little bit leery of going long the Euro in general as there are simply far too many troubles in that region for me to feel comfortable owning the currency.

Bounce, then fade

My suspicion is that this bounce needs to happen as the market has been so oversold for the last couple of weeks. However, when you look above you can see that there is plenty of resistance all the way to the 98 handle. While I suspect that we should have too much trouble reaching that area, it will be choppy at best.

It is because of this that I am not going to go along of this pair. I think however, that the 99 level should provide some resistance as it was such strong support previously, and this is the area that I will be looking for weak candles from which to sell this pair, and potentially make a little bit more profit than I could at current levels. I do believe however that the 95 level should be strong support, but in the end could give way. In order to feel comfortable shorting this pair, you should also be aware of the fact of what is going on with the Yen versus the US dollar. If that pair melts down, intervention could be right around the corner. If that's the case, it will not be safe to buy the Yen against any currency, including the Euro. However, as long as that pair is stable, the Bank of Japan will more or less be okay with this pair grinding lower.