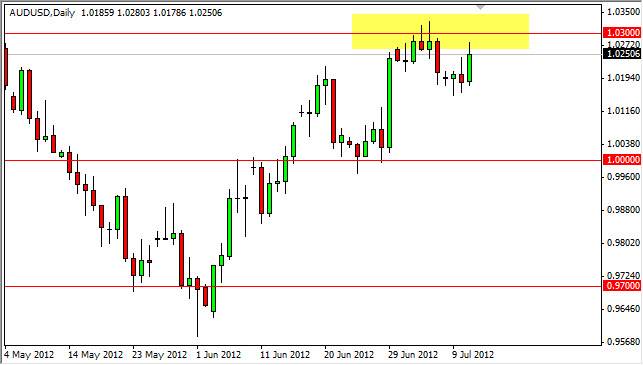

AUD/USD managed to rally during the session on Wednesday as it ran to the 1.03 resistance area. This was an area that's all significant resistance last week, and in fact is also the top of the shooting star from last week on the weekly charts. Because of this, I think this area is extremely resistive, and it doesn't surprise is that the market gave back a little in the last few hours.

However, this is an area that does interest me because of the fact of its obvious importance. On a break above the 1.0350 level, I would consider this pair broken to the upside and would be willing to go long at that point. Alternately, I see a break of the bottom of Monday's trading range as a signal to sell. This would probably run down to the parity level or so before ran into serious support, and if that gives way we would see a real rout in the Australian dollar.

Three levels

As I look at this chart, I cannot help but see that there are three significant levels to pay attention to. On the upside, I can see the 1.03 is obvious resistance and of course in the middle I see parity as being important as well. (This is often the case as many traders are attracted to "large round numbers.")

Below the parity level, I see the 0.97 area as significant support. If this level were to be violated in broken to the downside, I would suspect we would be in some type of serious financial situation. Is because of this that I feel we are more than likely going to bounce around between parity and 1.03 or so in the near term. However, if we break above the 1.0350 level, I would think that this pair could go much higher, perhaps to the 1.10 level before it's all said and done.

However, with Europe and China both slowing down, I find it a bit difficult to get that enthusiastic about the commodity currencies. As the Australians sell so much of their exports to the Chinese, we really need to pay attention the Chinese numbers. Of particular note, there is the employment numbers coming out today out of Australia, and that could move the markets as well. Nonetheless, I think long-term I have more of a negative bias in this pair - however, I would have to see some type of serious move lower to get aggressive about it.