EUR/USD

The EUR/USD pair fell for the week as the Euro crisis seems to be a never ending reason to be concerned. The 1.25 level looks as if it is going to attempt to be supportive at this point, but there are simply far too many reasons to sell the Euro to think about going long in this pair. The 1.30 level above is without a doubt going to be resistive, but I think that we aren’t going to be able to get there anytime soon. However, the breaking of this level would have me long if it could happen. On the other hand, a daily close sub-1.25, and I am selling again. Rallies that fail are also good candidates for short positions as well.

.png)

NZD/USD

The NZD/USD pair attempted to rally this past week, but failed in the end and formed a shooting star. The market looks very vulnerable at the moment, and it makes sense that the Kiwi could give way as the commodity markets look horrible. With this being said, I am short of this pair on a break below the bottom of the weekly shooting star, and the 0.78 level below it. I am not looking at the long side at all now, as the economic numbers from around the world are getting worse.

.png)

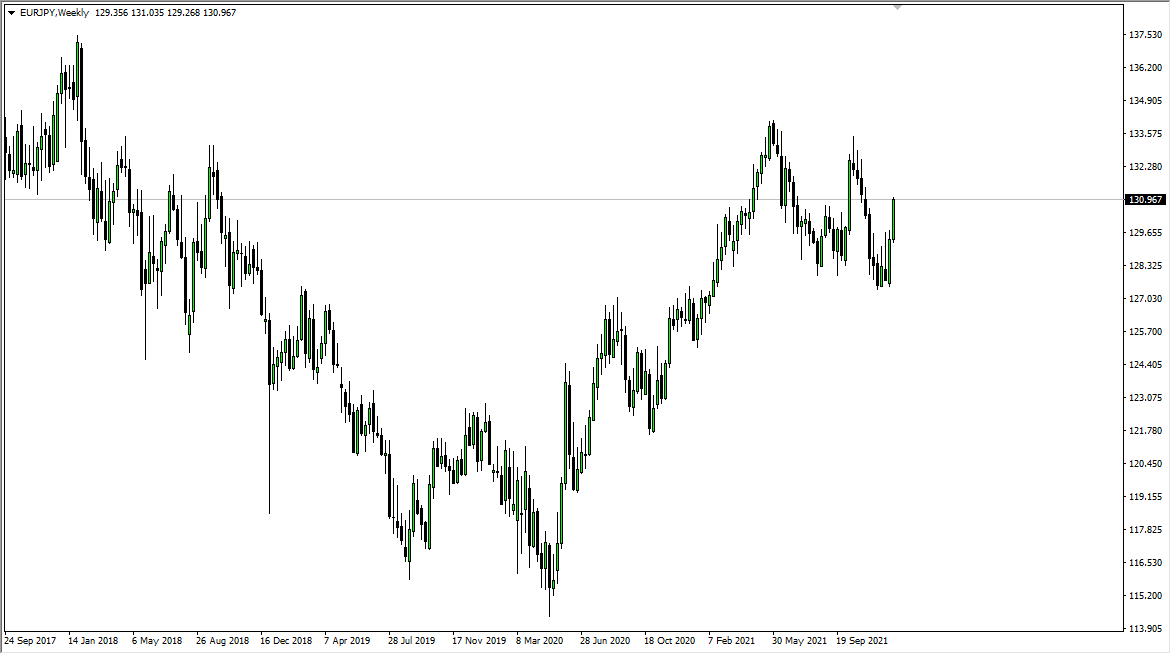

EUR/JPY

The EUR/JPY pair fell for much of the week, but has also bounced to form a hammer at the 100 level. This makes sense as the level will undoubtedly create interest in the pair, and second hammer in a row suggests that this pair could rise. If you look at the other Yen-related pairs, it appears that the Yen is weakening, and this move in EUR/JPY could have everything to do with the Yen, and very little to do with the Euro. I know I don’t want to own the Euro….

USD/JPY

Speaking of the Yen pairs and Yen weakness, this pair is a prime example of that in action. This pair looks as if it wants to continue higher, and a break above the 80.50 level would suggests that the move will continue. Because of this, I am buying this pair on a daily close above that mark, and I think we will see 84 before it is all said and done. I am not selling at all, as any long-term trades would run into Bank of Japan intervention long before I am comfortable.

.png)