EUR/USD

This is the pair that everyone will be watching. The reality is that the elections in Greece has been somewhat circumvented by the central banks, and their promises of intervention and liquidity if something goes wrong. (i.e. We are going to punish the Dollar.) However, I suspect that the initial pop that could appear is more than likely going to fail in the end. After all, there are still problems in Spain and Italy to worry about. I think we rise, but 1.30 will hold as resistance.

.png)

AUD/USD

The AUD/USD pair had a strong showing at the end of the week as the central bank statements came out. The pair managed to close above the parity level, and as a result looks set on running to the 1.02 level. This move could possibly set up another move to 1.04 or so. Ultimately, I like selling this pair, but a pop is almost guaranteed.

.png)

USD/JPY

The USD/JPY pair is one that almost everyone is short of. I personally don’t want to be, as the Bank of Japan is stepping up their rhetoric as far as jawboning the Yen in general. I think that the 80.50 level is crucial, and if we get above it – this pair can go much, much higher. I am not selling, but would consider buying at lower levels on supportive candles as intervention could come into play as well. If the 80.50 level gives way to the bulls, I think we see 94 at least.

.png)

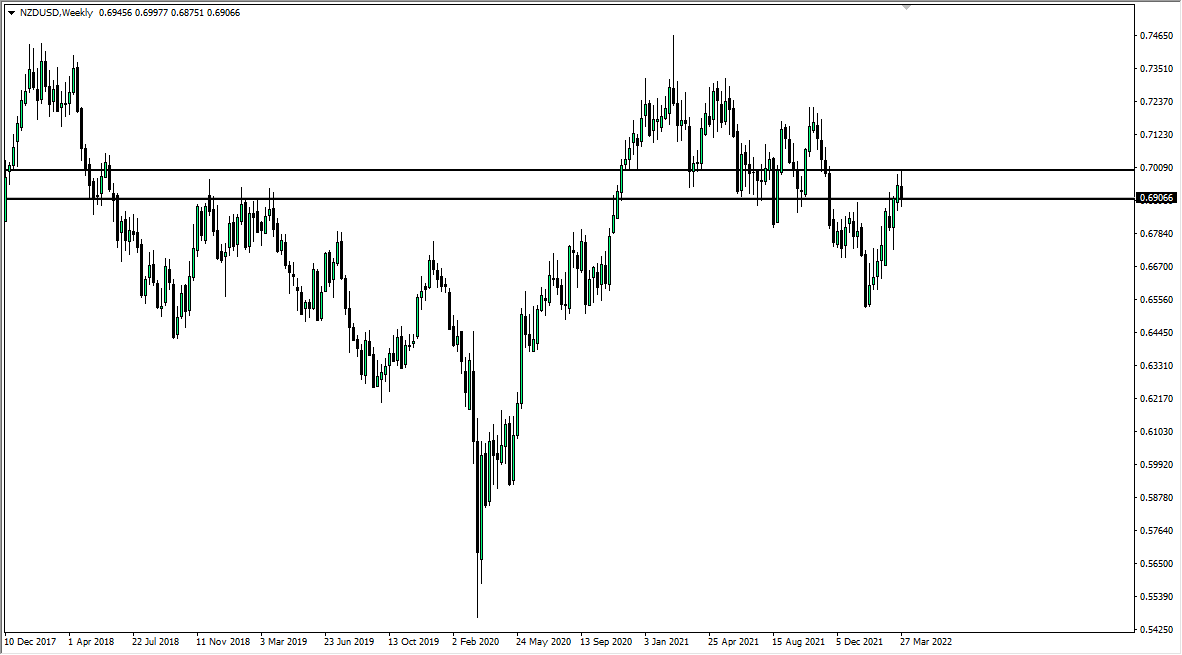

NZD/USD

If the election results in Greece go pro-Euro, this pair could be one of the more interesting ones. The Kiwi is highly sensitive to risk, and not nearly as liquid as the Aussie. This means that if there is a spike in risk appetite, this pair will soar. The pair has cleared the 0.78 level, and the 0.80 level looks to be the next target. However, like all other risk-related trades, I expect this to be a fade able rally in the end as the world asks more questions.