By: Christopher Lewis

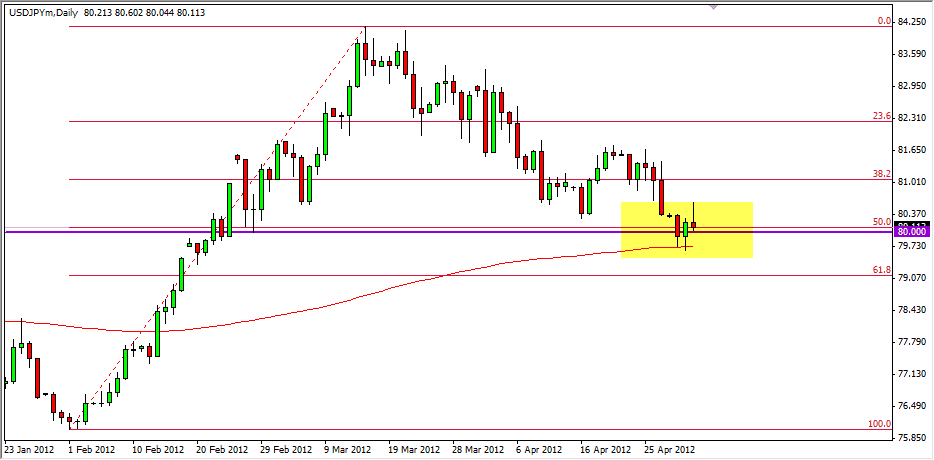

USD/JPY rose during the Wednesday session as the 80 level proved to be supportive. The last couple of days have seen this pair try to find a bullish tone, and as a result we now have the market trading above the 80 handle again. The market has been very bearish overall lately, and now the last couple of days will have to be deciphered as either a bounce, or serious support coming into the markets.

The 80 handle was the site of massive resistance just a few months ago, and even the two interventions by the Bank of Japan failed to push through it. Because of this, when the market broke above it, traders had to sit up and take notice. In fact, one of the most basic rules of technical analysis states that what was once resistance will then become support later. It is at this point in time that we are going to answer if this can be the case.

The Bank of Japan is currently working on expanding its asset purchase program by ten trillion yen, and this should dilute the value of the Yen overall. However, the Federal Reserve Chairman Dr. Bernanke has recently stated that the Fed has tools available to accommodate if the economy warrants it. This was read by the markets as potential quantitative easing, and as a result the Dollar has been beaten up recently. It is because of that that this pair can be thought of as a potential race to the bottom as two central banks are working so actively against their own currencies.

Confluence and Friday.

The Friday session brings in the Non-Farm Payroll numbers, and this pair will more than likely be heavily influenced by the release. This is because the market will gauge the likelihood of further easing by the Fed based upon the jobs number. If the US produces a sizable amount of jobs, the likelihood of the Fed easing goes down and this pair goes up.

The 200 day exponential moving average is just below, and although we formed a shooting star for the Wednesday session to counter it. While this would normally concern me from a bullish standpoint, the fact that the 80 handle, 50% Fibonacci level, and 200 EMA are all so closely placed, the reality is that we are probably looking at consolidation until Friday.