By: Christopher Lewis

The USD/JPY pair has been grinding sideways for some time now. The last couple of weeks have been a back and forth move, and as a result some traders that I know are already starting to talk like the pair should start falling again, continuing the massive buying of Japanese Yen. However, looking at the bigger picture, there are several reasons to think this is simply a pause, not a failure.

The Bank of Japan is essentially printing Yen as the central bank continues to buy the JGBs. (Japanese Government Bonds) This is a long-term cyclical change, as the Japanese population is actually declining. The one thing that has saved the Japanese from paying outrageous interest rates is the fact that it always had the population to rely on as they bought bonds. However, at 200% debt to GDP, this country is a “bug in search of a windshield” to quote the great John Mauldin.

Non-Farm Payrolls and the Yen

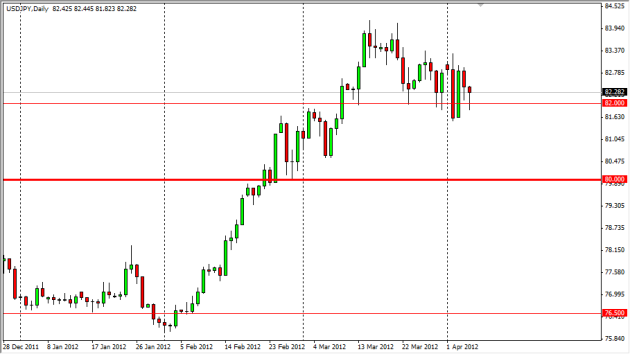

This pair has a long history of reacting positively to better than expected job numbers out of America. There is nothing to make me think it will be any different this time either. The 82 level continues to look supportive, and as a result I suspect it will hold the markets up during the session. (Unless there is a horrible jobs number.)

The hammer candle for the Thursday session shows just how supportive the market is trying to make this level, and as a result I am ready to buy on the first sign of bullish action. A break of the top of Thursday’s range would be a classic buy signal. Also, there is a hint of a possible bullish flag forming as well.

The 83 level has been resistive over the last few sessions, but in reality it is a minor area at best, and I think the pair will slice through it if the employment numbers are good enough. Above there is the 85 level, which is where the real fight, will be. I do think that it gives way eventually, and when it does – this becomes a long-term buy and hold pair like it was a few years back. I am very bullish of this pair, and already have a core position. Positive action tomorrow has me adding to those longs.