By: Christopher Lewis

The NZD/USD pair is one of the most favored pairs when it comes to expressing the risk appetite of traders. The Kiwi is especially sensitive to commodity moves as it is an exporter of many different agricultural products. The currency pair is the least liquid of all major ones, and as a result will often move much quicker than other “Com Dolls”.

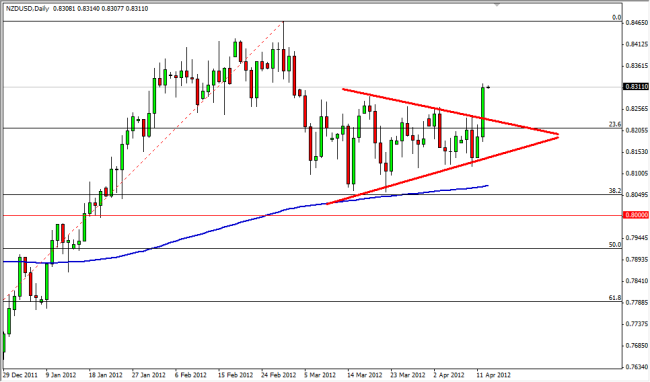

The Kiwi has also been very resilient lately as the markets sold off risk. In fact, the motion of this market was simply sideways while many of its contemporaries fell. The commodity dollars in general have had a rough way to go over the last couple of weeks, but this pair stood firm, forming a triangle in the end.

Symmetrical Triangle

The triangle that the pair had formed over the last couple of weeks was symmetrical in shape, and as I had pointed out in earlier analytic articles – supported. The 38.2% Fibonacci retracement level was just below it, as was the 200 day exponential moving average. With that being said, the path of least resistance would always have been to the upside.

The pairs shot straight up on Thursday, and broke out of the triangle as a result. The candle ended at the very top part of the range for the session, so it does suggest bullishness in the near future. Also, the market has been in an uptrend over the long term, and this latest move shows that the overall trend is still intact.

The triangle itself is suggested a move to the 84.50 level based upon a measurement of the triangle. The cards all line up for the Kiwi at the moment, and as the Aussie was falling most of the last month, the Kiwi should continue to be stronger. As an extension, this pair should outperform the Aussie and Canadian dollar going forward. Because of this, I am actively buying the Kiwi going forward as the pair looks set to go back to the 84.50 level. Selling isn’t a thought in this pair until I see a close below the 79.25 area, which is the 50% Fibonacci retracement level.