By: Fadi Steitie

Currency: EUR/USD

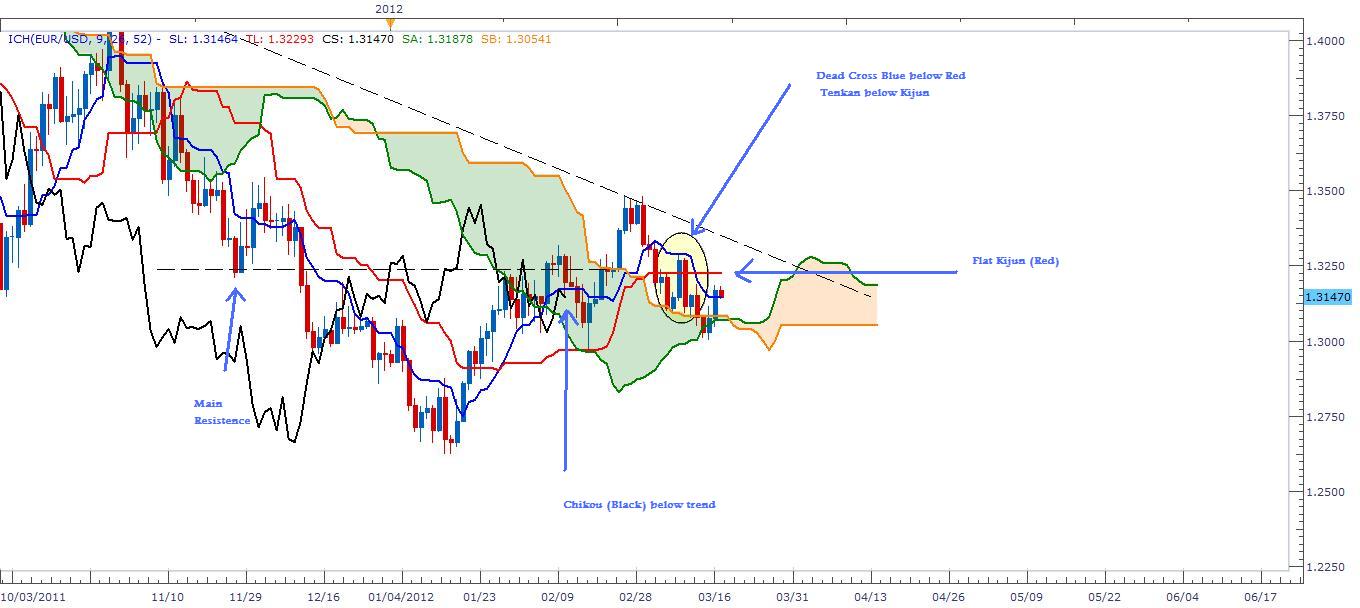

Trend Expected Direction: Down within a falling channel.

Method: Ichimoku Kinko Hyo and Candle Sticks.

Description: Looking at EUR/USD from different type of analysis (Ichimoku Kinko Hyo) and Candle Sticks, A Bearish Engulfing crossed kijun sen (Red) just above Kumo (Cloud) which indicate a turn in trend from Bullish to Bearish with a dead cross Tenkan below Kijun (Blue below Red). We can notice also that Kijun went into a flat shape which indicate a solid resistance level that matches the resistance in November 28, 2011 (Blue arrow). Now what confirm the bearish signal at last is the black Chickou (Black) of the past 26 days crossed and went below actual trend. I do suggest traders to either short and hold the pair with open target or to wait until price bounce to a higher level near 1.32450 or 1.32300 and action the short call. This trade might throughout the week.

Recommendation: Watch the market and short @ 1.32450

Target Area: Open

Stop Loss: 1.3400