By: Bastian Rubben

The US indices started the trading week on the red territory as this morning the futures are down and this might be the opening bell for the bearish correction that everybody were waiting for. However, keep in mind that the general trend is still bullish and every time that the stocks seemed like they were about to crash, a bullish day came right after and put the short-positions players in a lot of pressure. Therefore, it would not be wise to open short positions in this point unless we see a strong break-down of the support at 2600 points in the NASDAQ's daily chart, and a break-down of the S&P 500 at 1360 points.

The US stock markets usually have a negative correlation with the US dollar but yesterday we saw a mixed trend in the USD versus the major currencies. The EUR & GBP were able to block the strengthening of the American dollar but the continuation of the declines in Wall Street will make it much harder for them to remain powerful. Nevertheless, the analysis from yesterday, regarding a possible bullish reversal in the EUR, is still valid in case the EUR breaks above yesterday's high.

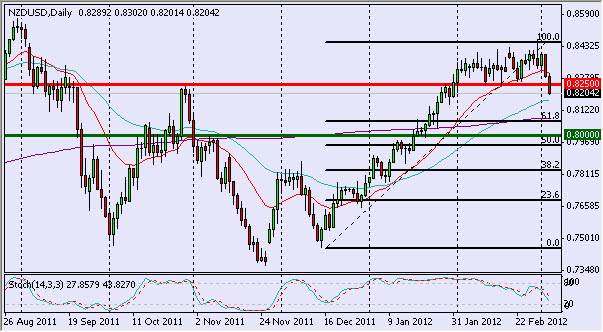

One of the currencies that the USD did get strong against was the NZD. The pair NZD/USD broke a significant support at 0.825, which was a break-up level several weeks ago. The Kiwi is a currency that attracts many investors due to the interest rate arbitrage between the US and New Zealand, and that is why it is such a powerful currency. However, on the technical aspect, a correction for the recent rally should have come and the target for this bearish session is the round number 0.80. Before that, the pair might get support by the 200 SMA, around 0.81.