By: Christopher Lewis

The EUR/USD pair recently has been a headline driven currency pair to say the least. With the acceptance of a second bailout and the ducks all being aligned in a row, the pair got a bit of a boost towards the end of the week. However, as the details out of Europe continue to come out, it appears that traders don’t like what they are seeing.

The bond markets are without a doubt the area of most concern, and that being said – we have extremely high rates in several countries. Judging by the yields that we are seeing, Portugal is about to become a problem as well. The fact of the matter is that the European Union has several issues facing it, and as long as this is the case – the Euro will fail to gain significant traction.

While the immediate problems have been wallpapered over yet again, the reality is that the European mess is likely to take a few years to completely sort out. In other words, there is always going to be something to be concerned about in the near term with this currency. It is against this backdrop that I simply won’t own the Euro against most currencies, and this is especially true against the Dollar as it is both a safety currency, and a play on growth as the US is expanding.

Support below

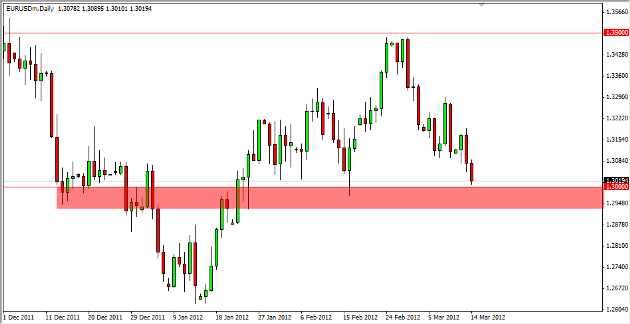

With everything above being said, we are presently trading in the middle of a massive support zone. This zone is 200 pips tall, and we are roughly in the center of it. (I see this as 1.31 to 1.29 on the chart.) It should be said that the action looks especially weak, but I am going to need to see a daily close below the 1.29 mark to start selling.

Perhaps it is because if there is one currency that traders seem to have unending faith in, it’s the Euro. Only God knows why, but I simply cannot fight what the market wants, no matter how little sense it makes to me. With this in mind, I am selling a daily close below 1.29, and will sell rallies that show weakness.

See today's free EUR/USD signal now to find another way to profit in the market.