Trades placed by optionFair

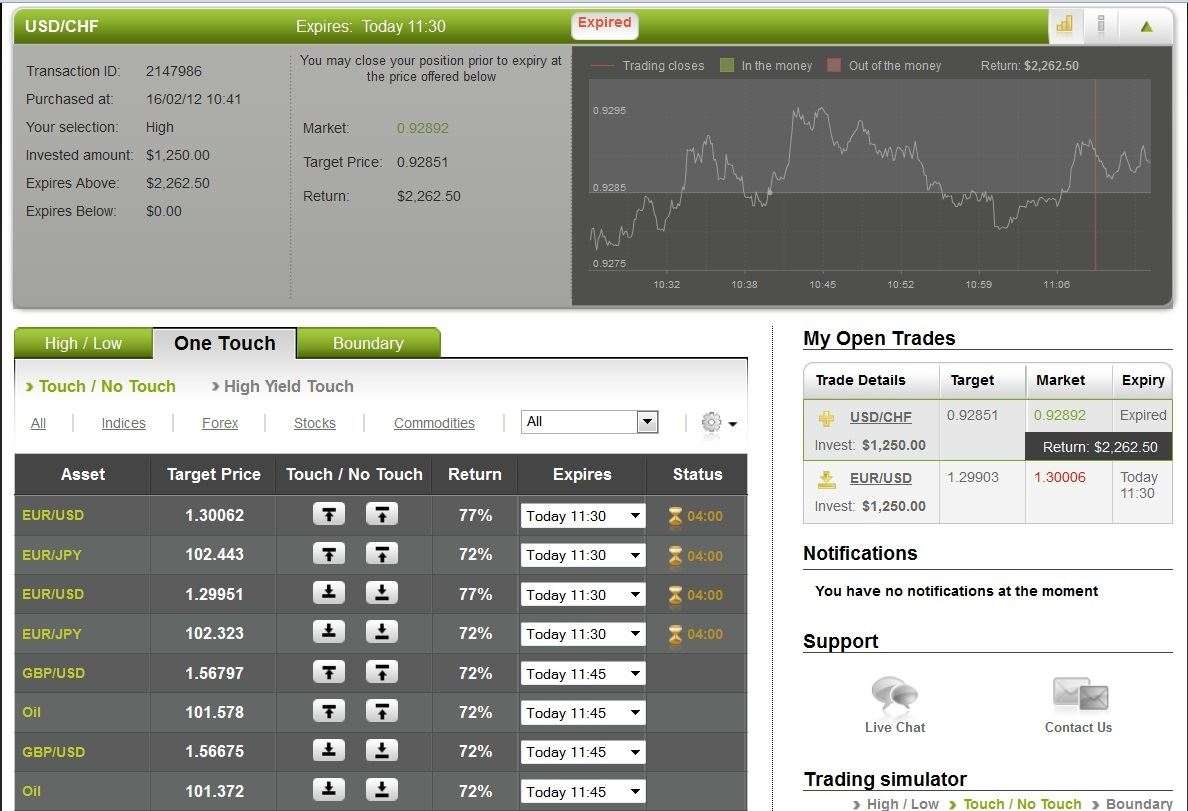

USD/CHF

According to Christopher Lewis’s analysis of the USD/CHF, the 0.91 level is the support that I believe should continue to hold this pair up. The price level a stock has had difficulty falling below. It is thought of as the level at which a lot of buyers tend to enter the stock. That creates an opportunity on the “High” instrument.

I logged in the optionFair™ Binary Options Trading Platform and I traded on the “High” instrument. This kind of option has a return of 81% if the option expires below the strike price.

I traded with $1,250 on the strike price 0.92851 at 10:41 for the expiration of 11:15. At the expiry time the market price was 0.92892 which is above my strike price. I won my position and earned $1,012.

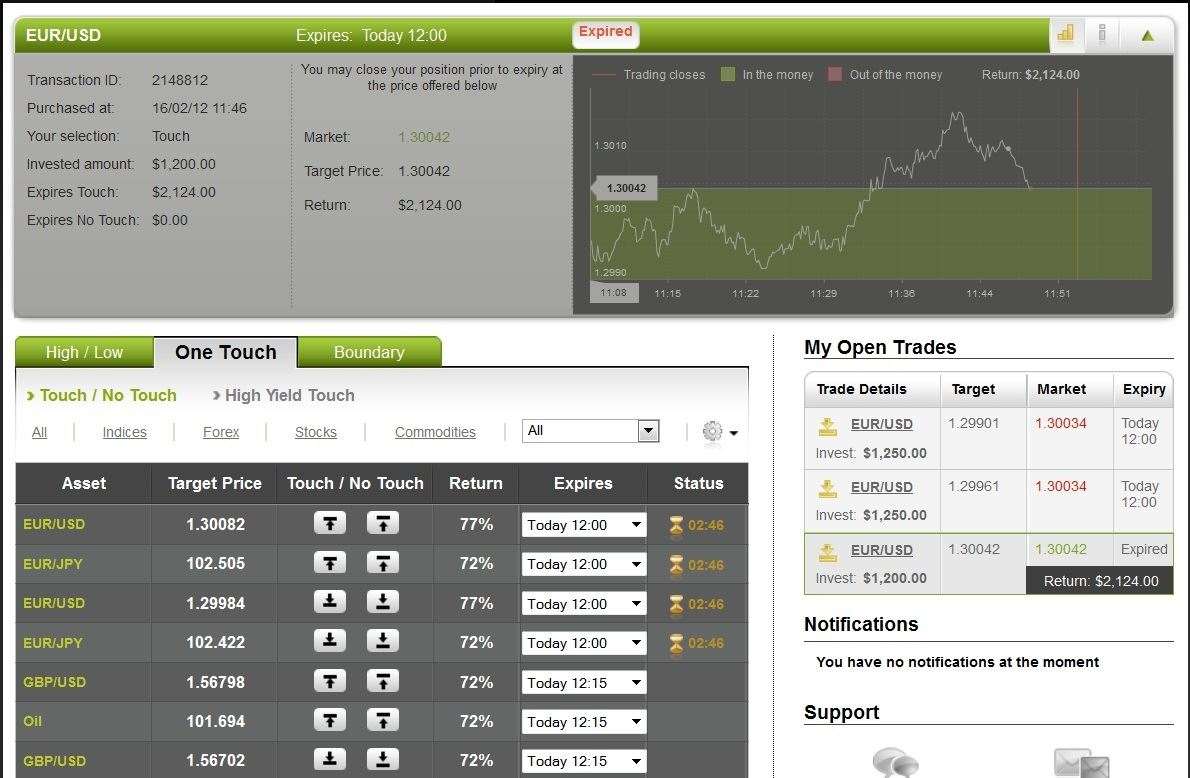

EUR/USD

According to Colin Jessup’s analysis of the EUR/USD, he expects this pair to be bearish at the price below 1.3050. Believing that a particular security, a sector, or the overall market is about to fall which is opposite of bullish. That creates an opportunity on the instruments: “Low”, “Touch Down” and "No Touch".

I logged into the optionFair™ Binary Options Trading Platform and the market price at 11:46 for the EUR/USD was 1.30098. I decided to trade with $1,200 on the “Touch Down” instrument and got the target price 1.30042. This kind of option has a return of 77% if the option hits the strike price prior to expiry.

At 11:48 the market went down and hit my strike price in just 2 minutes and I won $924 on my investment.