By: Christopher Lewis

EUR/USD

EUR/USD fell again for the week, and looks very, very weak at this point in time. The 1.29 level giving way was a significant breakdown, and looks set to see lower prices. The 1.26 level below is the next hurdle for the bears, but more than likely we will see this happen. If that level gives way – look to see 1.19 in the near future. Buying the Euro at this point in time is very risky as there are just so many problems in the European Union.

USD/CAD

USD/CAD initially fell during the week as the oil markets have been very active. The Iranians are threatening to close the Strait of Hormuz in reaction to a boycott by the Europeans of Iranian oil. The oil markets are very volatile at the moment, and the USD/CAD follows this pattern. However, the weekly movement formed a hammer that showed support at the 1.01 level. The 1.01 level has been supportive before, and the hammer suggests that we are looking at higher prices. There is a larger triangle being formed, and a break above the downtrend line is bullish, while a break below would have to fight the support levels at 1.01, parity, and 0.99 going forward.

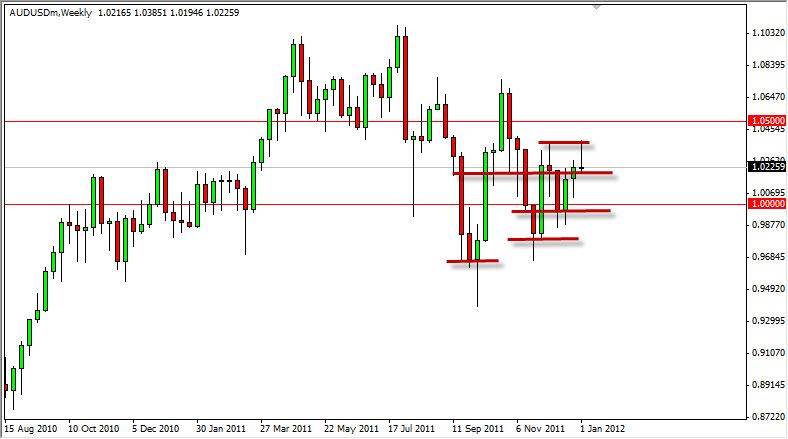

AUD/USD

AUD/USD had a shooting star form for the week, after forming a hammer the previous one. The pair looks like it is trying to wind up for a move as the range keeps getting tighter, but there are so many levels of support and resistance going forward that this pair will more than likely trade like the commodity markets – sloppy. The fact that we have seen a hammer followed by a shooting star suggests that we are going to be range bound and more of a scalper’s market in the near term.

USD/CHF

USD/CHF rose during the week, and has even broken above the top of a shooting star from three weeks ago. The 0.95 level has given way, and the fact that the Dollar is strong everywhere bodes well for the bulls in this pair. Add to that the fact that 80% of Switzerland’s exports go to the European Union, and you have a recipe for a nice long-term bull trend. I am currently long this pair, and in fact am willing to add on dips. The pair will grind, not sprint. Parity is my target for the time being.

EUR/CHF

EUR/CHF finished the weekly basically unchanged. However, the weekly chart doesn’t give the action its due justice – it was choppy. The pair has the “floor” put in by the Swiss National Bank at the 1.20 level, and the 1.25 level has continued to keep the pair down. The 1.25 level is a major resistance area, and one would have to think that the European Union would have got its act together in order to want to buy the Euro for any real length of time. However, the 1.25 level being broken would be a career-making trade for the long-term. If we break below the 1.20 level, the Swiss National Bank will intervene. I am currently buying dips on shorter time frames in this pair, but only with small position size.