By: Christopher Lewis

USD/JPY has been stuck in consolidation for quite some time. The Bank of Japan has been working against the value of the Yen, and this pair is its main instrument for doing that. From time to time, the Japanese central bank will intervene in this pair, selling the Yen against the Dollar in order to keep the rates in an acceptable range.

The biggest concern for the Japanese central bank is the effect that this pair has on exporters. There are many companies in Japan that export massive amounts of goods to America, such as Sony, Cannon, Honda, and many other well-known brands. The effect that a higher Yen has on the economy of Japan simply cannot be understated.

Because of this, there will often be levels that the bank protects. It should also be noted that sometimes major exporters will step into the markets and protect areas as well. A friend of mine used to work a currency desk for Honda, and he would often try to protect their profits this way. (In concert with several other Japanese companies.)

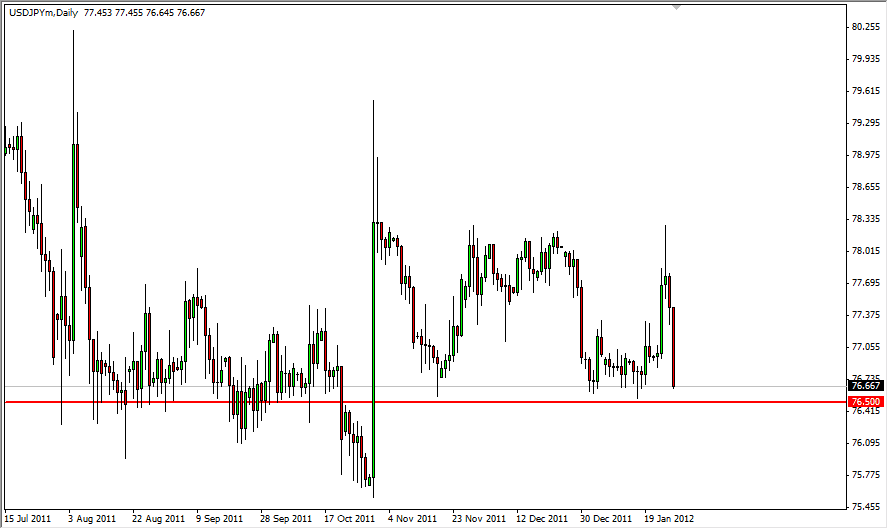

The recent move by the Federal Reserve to keep interest rates ultra low until the end of 2014 has sent most traders selling the Dollar over the last few sessions. The USD/JPY pair of course isn’t going to be any different, and as a result we have seen a run straight down to 76.50, which is an area of serious interest at the moment.

Brick Wall

The pair has seen the 76.50 act as an almost impenetrable barrier. There are a lot of possibilities, but it is obvious that someone with a lot of money has no real interest in seeing this pair fall much below this level. The first and most obvious suspect is the Bank of Japan. Clandestine operations wouldn’t be anything new, and they are one of the few players in the market that could accomplish this. Of course, it could be a group of exporters, but the absolute ability leads me to believe the former of the two to be the right answer. None the less, it doesn’t matter.

The pair can be bought near these levels on any sign of supportive price action as one would have to think that the BoJ will step in before too long if this keeps up. The selling of this pair is obviously not possible at the point. I will use the one hour chart to enter the pair, and will use hammers, bullish engulfing candles, and just larger green ones to enter.