By: Christopher Lewis

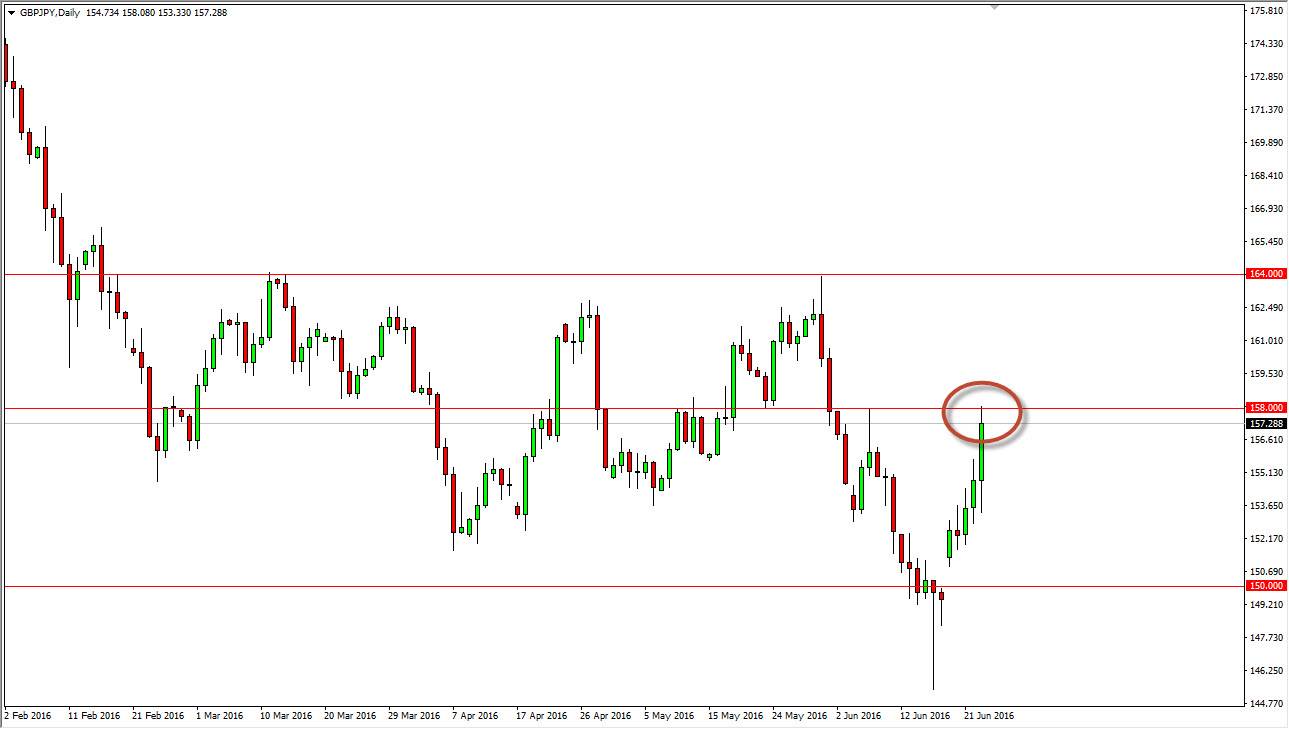

GBP/JPY continued to fall on Thursday as the risk appetite of traders waned yet again. The pair has been decidedly bearish overall, and looks like this theme could continue. However, we have a Non-Farm Payroll report coming out later today that will certainly have its say with the highly risk-sensitive pairs such as this one.

The pair is notorious for wild swings on Non-Farm Payroll Friday. The pair tends to rise when good news hits the wires and fall when bad news does. However, the world is more interested in the situation in Europe, so I believe that the reaction to the Non-Farm Payroll number will be an opportunity to look for unbalanced markets – and this one could be a good candidate.

The reaction to a strong number will undoubtedly push this pair higher at first as traders start to feel good about risk. However, this reaction could very easily be a quick move only as the world continues to worry about Europe. The issues in Europe could at least in theory wipe out any push higher in the Americas as far as the US and Canadian economies.

Triangle could be forming

The pair is also at the bottom of what could be a descending triangle that has been forming since October of 2011. The pair does have the Bank of Japan to contend with, although they aren’t necessarily worried about this specific cross. The Japanese are more concerned with the USD/JPY pair, and it should be noted that the EUR/JPY is hitting fresh lows every day, which means this pair might need to play catch up.

The 119 level is considered to be strong support at this point. While a break below this isn’t necessarily expected right away, a move below that level would signal lower prices and the first target would have to be the 117.50 level which is roughly the low from September of 2011. The pair could perhaps bounce from a good announcement out of America, but to expect the triangle to break to the upside is asking a bit much as it wasn’t the US job market that had so many people worried in the first place. If the NFP number is good – it simply will highlight how much better the North American economies are doing than the European ones. (Britain included.) On a pop, I will be looking to sell as we approach the 121 area.