By: Christopher Lewis

The last several months have seen violent market moves in the EUR/USD pair based upon meetings, rumors, theories, and general market noise. However, as we are starting to head towards the 1.30 level, the October lows have been violated, showing a major shift in not only sentiment, but potentially the momentum as well.

.png)

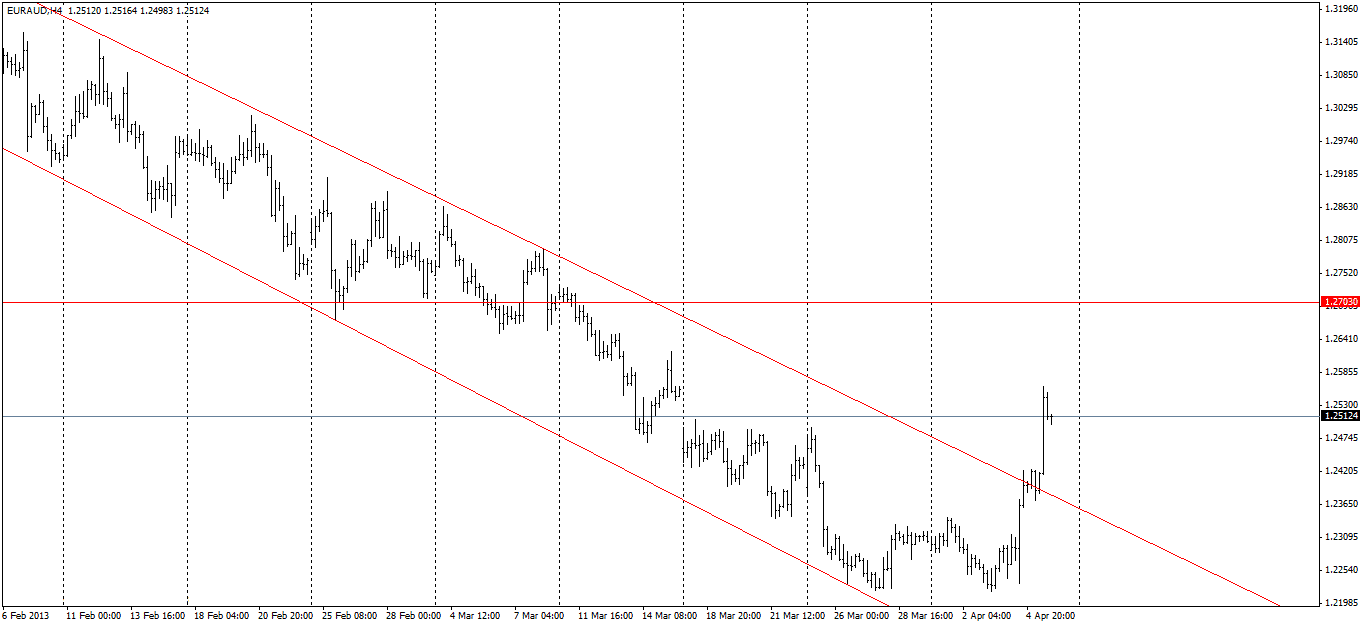

The various markets that are Euro denominated are all showing the same thing, and as the world becomes increasingly impatient with the Europeans and the seemingly lack of concern in that area, the Euro in general should continue to fall over time. The long-term outlook isn’t good not only because of the debt crisis, but also because of the recessions that are going to come about due to severe austerity measures being taken by several of the EU countries over the next few years.

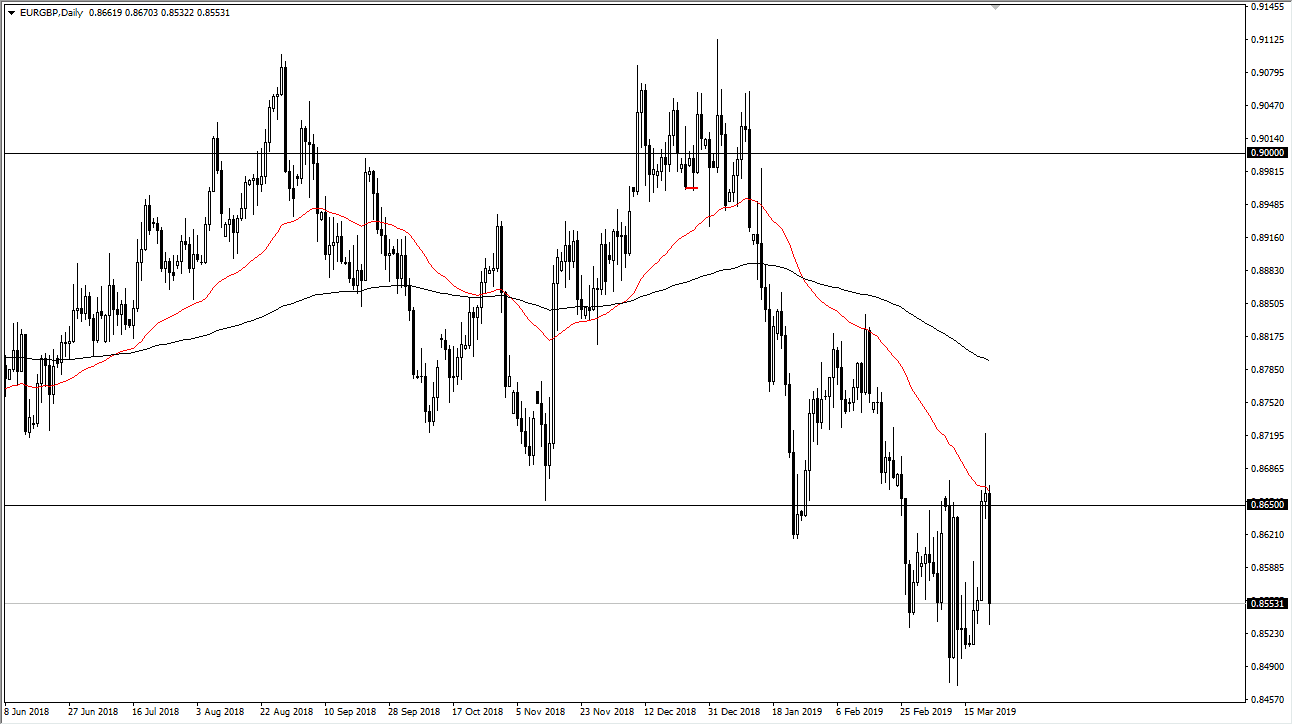

Looking at the EUR/GBP pair, we can see that the 0.8500 has been significantly broken, and with this we see a major support area giving way. This pair has been stuck in a range from 0.88 for quite some time, and this recent breakdown becomes even more interesting considering it happened right after the now infamous David Cameron refusal to sign up the UK to the newest reforms in the EU. Perhaps history will look kindly on Mr. Cameron.

The breaking of both of these levels ensures that the Euro is the problem, and it isn’t some part of a larger move down in risk or anything like that. (Although that certainly is going on as well.) The EUR/AUD has been weak, and the EUR/CHF pair simply cannot gain any traction, even with the Swiss National Bank refusing to allow the pair to fall much. When you can’t appreciate against a currency that is being worked against – that’s a really bad sign.

The fact that the world is running from the Euro in other pairs than against the Dollar is particularly worrying for the Euro bulls. Until the EU takes its issues a bit more seriously, there simply is no reason for this currency to rise in the near future.

.png)