By: Christopher Lewis

EUR/USD

While the pair has been very choppy lately, the truth is that the pair has been almost 100% news-driven over the last several months. This should continue as the G20 failed to produce much at all in the terms of help. It was suggested that the Germans back some of the bailout from the various institutions in the form of their foreign currency reserves and gold – which was shot down straight away. We are reaching a point where the EU is completely dysfunctional. Because of this, I expect choppy conditions to continue, but with a downward bias. The 1.39 - 1.40 resistance area should be a cap of sorts on this pair unless something special happens.

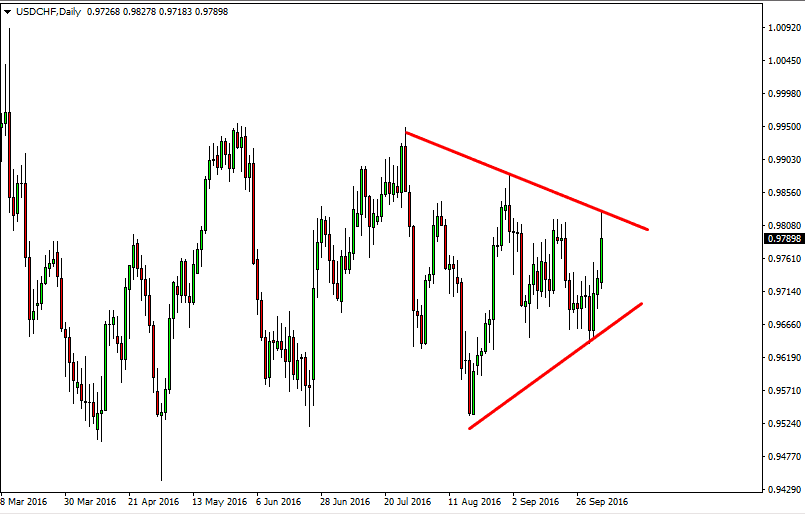

USD/CHF

As you can see by the chart attached, the Swiss National Bank has actually managed to change the trend of this pair when it announced a “floor” in the EUR/CHF pair of 1.20. The purple trend line on this chart was a major one, and now we have seen a pullback as well. The 0.8500 level looks very supportive, and we think 0.9000 breaking could happen soon. A break above that level has us aiming for 0.9500, and then parity.

With the Swiss working so hard against the Franc, it takes the “safe haven” status of that currency away for the time being. Because of this, when there is fear and trouble out there the Dollar gets a bid. (Remember, the Yen is being worked against as well.) Because of this, we expect this pair to rise over time, and you obviously cannot sell it.

USD/CAD

This pair is an interesting study in several competing factors. The two economies are intertwined in major ways as the Canadians sell 85% of their exports to the US. The pair had a massive bounce from just under the parity level last week, and is driven by oil prices. The oil markets are absolutely crucial for the CAD most times, and it seems especially so now. Both the oil markets and the USD/CAD look like they are going to be choppy at best.

The real hurdle for this pair is the 1.03 level. It the fear trade comes back with a vengeance, you could see this pair rise as the Dollar gets the safety bid. A daily close above that level would be very bullish. With the 0.99 – parity level being so supportive, and the 1.03 level being so resistive, consolidation between those two areas is probably the most likely outcome.

GBP/USD

The cable fell during the previous week, but bounced in the end to show a massive hammer at 1.60. The pair looks like it has broken out, and wants to reenter the 1.60 – 1.65 consolidation area. The breaking of the top of the weekly candle is a bullish sign, as it confirms support holding at 1.60. If the bottom of this candle gets broken – that is a sign of bearishness as the candle is now a “hanging man”. This pair will clearly be influenced by headline risks in the short-term, as most pairs will be.

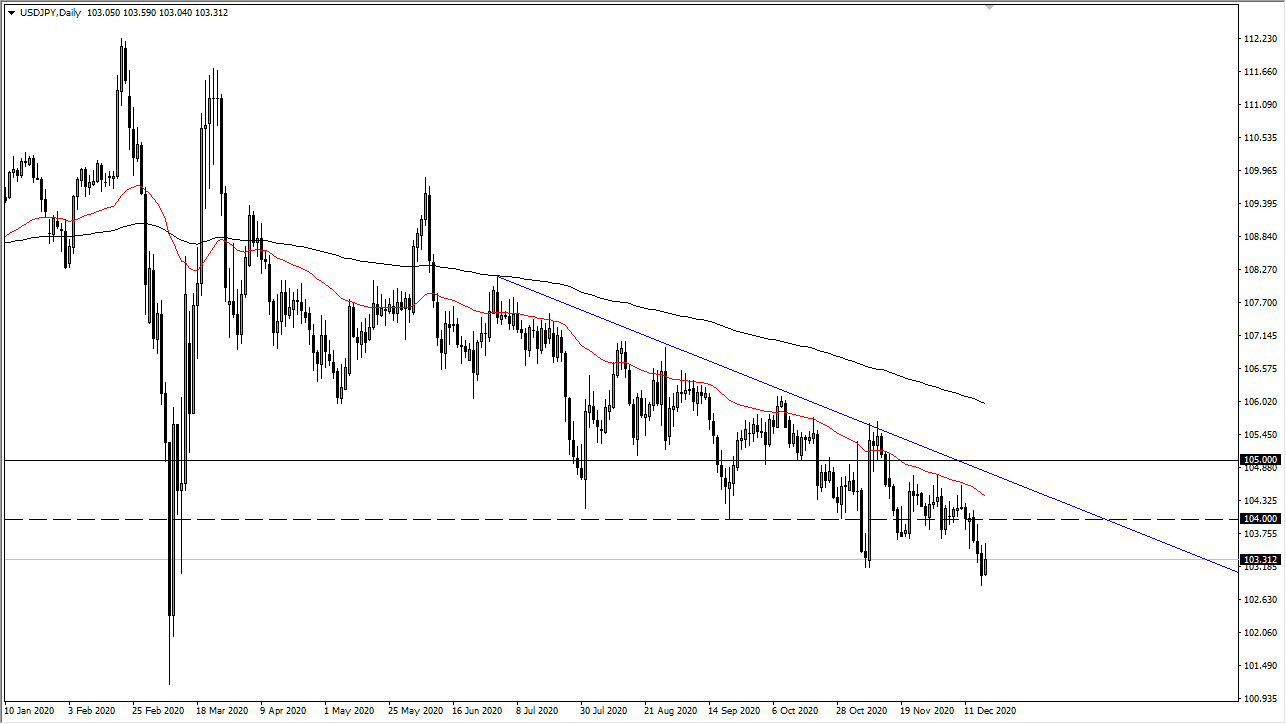

USD/JPY

The USD/JPY produced fireworks last week as the Bank of Japan intervened on Monday. The pair didn’t break the all-important 80 handle though, and the intervention was unilateral. The history of these “one-offs” has been a gradual fade back down, and I see no reason why this time will be any different. I look for a gradual weakening of this pair back down to the 76 handle.