By: Christopher Lewis

One of the most heavily influenced currency pairs by the Non-Farm Payroll announcement is the USD/JPY. The pair is a well-known “risk sensitive” market, and will often be the focal point of traders – especially if the reports are good. However, recent developments make this pair likely to head in only one direction for the foreseeable future.

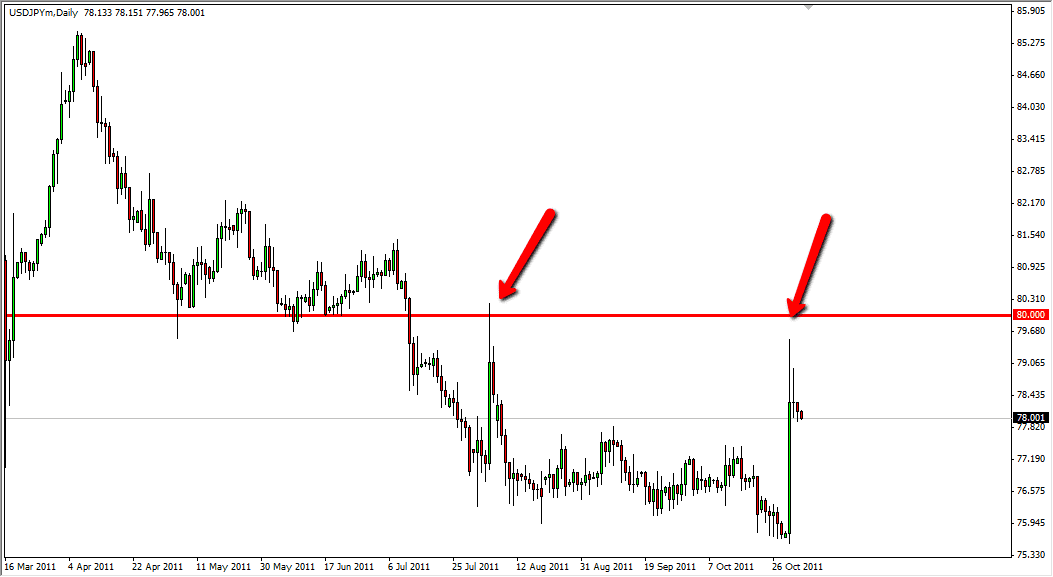

With the Bank of Japan intervening during the early hours of Monday, the USD/JPY skyrocketed to well above the 79 handle in a very short time. The bank also was said to have acknowledge that the action was unilateral, which in times past has been nothing short of a failure. Central banks that intervene on their own rarely have success, and the Bank of Japan even has recent proof of this in the form of an intervention on August 4th.

After the August 4th intervention, it took only 5 days to retrace the entire gain this pair made. This is because the fear in the markets simply is far too strong to think this risk sensitive pair can gain for any sustained length of time. The 80 handle seems to be the real barrier, and the Bank of Japan hasn’t been able to get the level of this pair back above it. This shows just how much resistance there really is at that level – two interventions and no success.

With this in mind, you can only short this pair form these lofty levels, as the pair looks set to fall again this time. The last couple of days have shown that there is absolutely no momentum to the upside, and any pop in this pair that fails to close above 80 is simply an invitation to sell again. In fact, many traders will be hoping for a great Non-Farm Payroll announcement that might possibly cause a knee-jerk reaction that they can fade. If the report is poor, it will simply create more downward pressure on a pair that has the weight of the world above it.