By: Christopher Lewis

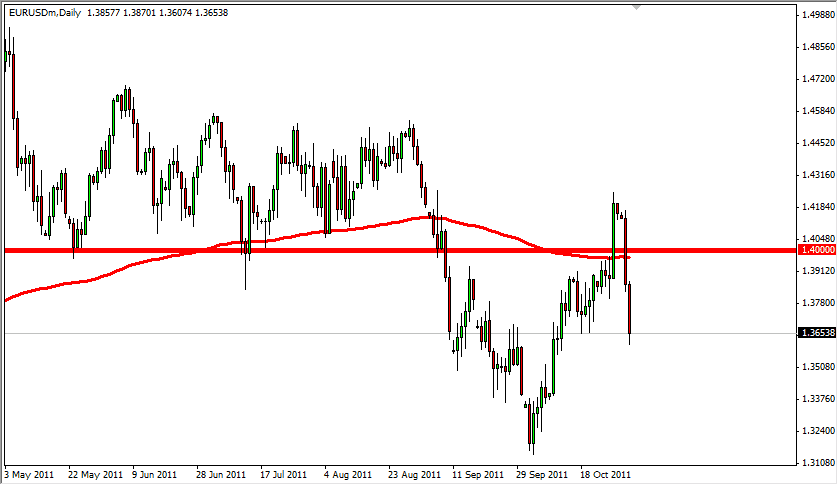

The EUR/USD has started out the week with a real bang. The pair has fallen apart from the euphoria that last week saw when the announcement came out about the EFSF. The pair shot straight up, and the optimism seemed almost palpable as the EUR/USD sliced through the 1.40 resistance area like it wasn’t even there.

However, several things have happened over the last few days that have dramatically changed the landscape for this pair yet again. It appears that the European leaders didn’t ask the Chinese whether or not they were willing to buy the bonds from the EFSF fund. It appears that would have been a good idea as Jinbao said over the weekend that they weren’t necessarily inclined to do so. This leaves the question of who will be bothered to get involved in this market. Also, at this point – who is buying the standard sovereign bonds of the single EU countries when these are so much more protected than say Portuguese bonds?

Adding fuel to the fire, the Greeks have announced a referendum on the EU bailout package that the public gets to vote on. Yes, the very same public that has been striking and rioting in Sygmata Square. Any idea on how that vote is going to go? This could be the beginning of a Greek departure from the EU, and most certainly a default.

Fitch has said a 50% “haircut” in Greek bonds would be a technical default, and would trigger CDS markets as the insurance would be needed. There is talk that the EU is going to step in and try to prevent that from happening. This is the same EU that announced a credit downgrade as a result of the bailout wouldn’t be “allowed”. Good luck telling the American agencies that, EU.

Looking at the chart, the EUR/USD has absolutely collapsed over the last 48 hours. The 200 day moving average is now above the price, and the 1.40 gave way just as easily to the downside as it did to the upside. The move that we have seen is testing the 1.36 handle, and a bounce could be seen here, but the truth is that a move like this normally means something. And in the case of the Euro, it means that any bad news will push this currency down. The pair looks like it is a good situation in which to sell rallies at this point, as retracing the fall would truly be a remarkable move, which should only be seen if the EU actually fixes the issues that they are in at the moment, which as far as most people can tell are completely structural.